Learning about property can be daunting when you’re just starting out, especially when you’re confronted with unfamiliar terms like freehold and leasehold from the get-go. But understanding what these terms mean and how they affect your long term investment horizon will be crucial in helping you make an informed property purchase decision.

Leasehold condos are properties with definite lifespans. They are built upon land with limited tenure that will eventually be returned to the government once the lease lapses. The two most common tenure lengths that you’ll find on the market are 99-year and 999-year leases. As far as property investment is concerned, 999-year leaseholds are as good as freehold condos in the sense that time does not decrease their value, since it’s practically impossible to outlive a 999-year lease.

On the other hand, 99-year leasehold condos will depreciate in value over the course of several decades. This is because the remaining lease does not reset even when homes are transferred from one owner to another. For example, if you sell your 99-year leasehold condo after 39 years after you initially purchased it, you’ll be handing over a condo with 60 years of remaining lease to your buyer.

While other factors such as the development of surrounding facilities and general inflation can counteract lease depreciation in the first few decades. As the lease approaches the end of its lifespan, its value will rapidly decline as fewer buyers will be willing to spend hundreds of thousands of dollars on homes that they can only stay in for a few years. This is not to say that older leasehold condos are invariably less valuable. Thanks to their lower price point, older condos (if maintained well) have the potential to offer good rental yield as well.

What happens when the 99-year lease runs out?

Once a condo’s lease reaches 0, the land on which the property is built will be reverted back to the state. Private home owners may appeal for a lease extension by applying to the Singapore Land Authority (SLA). Ideally, appeals should be submitted more than three years before the lease expires, although concessions will be made on a case-by-case basis. Lease extension will only be approved after the SLA has conducted an assessment of your land’s market value and the development potential of the area.

Even then, home owners applying for lease extension should be prepared to pay a hefty premium for their lease extension. Homeowners should be prepared to move out in case their appeal fails, in which case they will not be entitled to any compensation, either.

While debate surrounds leasehold properties, recycling the common good of limited land space is essential for keeping facilities fresh and relevant, especially since Singapore has such limited space to begin with. In addition, lease expiry also acts as a soft reset button for the property market, preventing prices from ballooning out of control over multiple resales.

Are HDB flats freehold or leasehold?

Housing Development Board (HDB) flats mostly comprise 99-year leasehold properties that function in a similar manner to leasehold condos as far as property ownership is concerned. Since HDB flats are public housing units designed to be affordable to the majority of Singapore’s population, buyers will be entitled to a wider range of government grants and subsidies if they opt for an HDB flat compared to a leasehold condo.

What are the benefits to owning a leasehold condo?

Your income determines the upper limit of the housing loans that you qualify for, and ultimately the type of home that you can comfortably afford. While it may be tempting to go for a freehold condo for its investment potential, understand that you’ll have to pay for a myriad of living expenses while you wait for your property to grow in value.

1. Leasehold condos cost less upfront

Property investment is just one way to make money. Many homeowners have gone the route of buying a cheaper leasehold condo and investing their savings in other short term investment vehicles. You can even use the extra cash to decorate your home interior to your liking, because don’t forget — the cost of a home includes renovations and furnishing as well.

Typically, leasehold condominiums are priced lower as compared to the freehold properties. For instance, we can observe the difference in prices by looking at an example of two resale projects in the Orchard planning area. According to the data retrieved from URA, the average unit price of Cairnhill Nine was $2,626 psf in the first 4 months of 2022. Whereas for 3 Orchard By-The-Park, a freehold property, the average unit price was $3,643 psf. This is clearly a 39% price difference.

The same price trend can also be observed for a new launch project as well. For example, comparing two developments in the Bukit Timah planning area. According to the data retrieved from URA, the average unit price of Fourth Avenue Residences, a 99 year leasehold property, was $2,491 psf in the first 4 months of 2022. Whereas for 15 Holland Hill, a freehold property, the average unit price was $3,077 psf. This was a 24% price difference between the two properties.

In essence, leasehold properties are generally priced lower than freehold properties. Although it is crucial to note that prices of properties are also influenced by a wide range of factors as well. Leasehold condos might be the wiser investment option for those who foresee themselves leaving Singapore in the near future. Homebuyers still stand to reap good profit from home resales, as long as they are able to hold their property for more than four years to avoid paying the Seller’s Stamp Duty (SSD).

2. Leasehold condos have better rental yields

Tenants may not focus too much on the remaining lease of the property and may only consider factors such as location, facilities and cleanliness. Between a leasehold and freehold condo that are comparable in all other aspects, a leasehold condo will generally give you higher rental yields — simply because you’ll be able to cover a higher percentage of your mortgage with rent.

How to calculate rental yield:

Rental yield = annual rental income / property cost

For example, Cyan and d’Leedon are freehold and 99-year leasehold condos in District 10 respectively. The two properties are similar in terms of location, giving residences access to the same range of facilities and amenities. While the quality of the development can also influence rental yield, both condos can offer their landlords a similar amount of passive income each month. In fact, the 99-year leasehold condo d’Leedon performed slightly better than its leasehold counterpart while also costing homeowners less.

| Condo Name | Tenure Type | Year of Completion | District | Median rent percentile ($psm** pm) in 1Q2022 | 1Q22 Sale Price Range |

| Cyan | Freehold | 2014 | 10 | 46.80 | $1.38m to $11.23m |

| D’Leedon | 99-year Leasehold | 2014 | 10 | 46.15 | $1,05m to $9.60m |

3. Large scale condos are generally leasehold

Remember how we were saying that land in Singapore is limited? That means that a limited amount of land are freehold sites. On the other hand, leasehold properties do not face this restriction, and can enjoy a greater amount of land as a result. In fact, many mega condos were built on leasehold land during the 2017 to 2018 en bloc craze.

Maintenance fees of leasehold condos tend to be cheaper as well, since they can be split amongst a greater number of residents that are housed on a larger piece of land.

Looking for an HDB or private property?

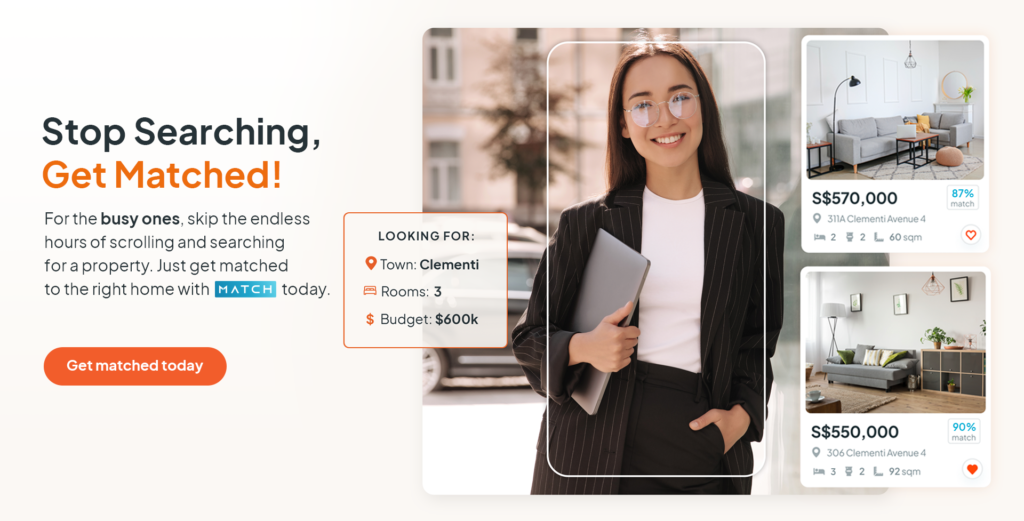

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home buying decision, so you no longer have to spend hours searching online for the information that you need. Because at Ohmyhome, we’re always by your side, always on your side.

You can message us in the chatbox at the bottom, right-hand corner of the screen to secure an appointment with any of our Super Agents.. You can also WhatsApp us at 9755 1009!