On a bright and early Saturday morning, we successfully held our third housing literacy seminar!

Homeowners and homeowners-to-be, we may be familiar with the steps of buying a property but may gloss over the stages that require more thoughtful planning i.e. the financial calculations and contra timeline planning. Staying true to our commitment to making housing transactions simple, fast and affordable, we conduct free seminars every third Saturday of the month that aims to share invaluable property knowledge in a fun and accessible way.

Helmed by our two senior property agents, Douglas Quah and Zen Lim (or D & Z for short), and held in our cosy public seminar chamber, the jam-packed two-hour seminar treated our participants to an exciting day of hands-on learning through live demonstrations on our app, detailed breakdown of tricky financial calculations and finished off with expert home loan advice from our resident mortgage specialist.

Here are some of the key takeaways from our third seminar.

Financial Calculations

Ever found yourself wondering about your outstanding home loan? Our agents showed how to find the amount by checking the HDB website (for HDB loan). The accrued interest accumulated from our CPF can also be found easily through the CPF website, all you need to do is log in to CPF by using your Singpass.

This was followed by a hands-on session where participants were instructed to find the estimated value of their property through the Ohmyhome In-app Valuation Tool. Once all these figures are accounted for, our participants are then ready to start their Financial Calculations! By using our in-app loan calculator, you can find out how much the maximum amount you can borrow from the bank. On the other hand, our cash proceeds calculator lets you find out how much cash you can receive after selling your property.

Enhanced Contra Facility (ECF) Timeline

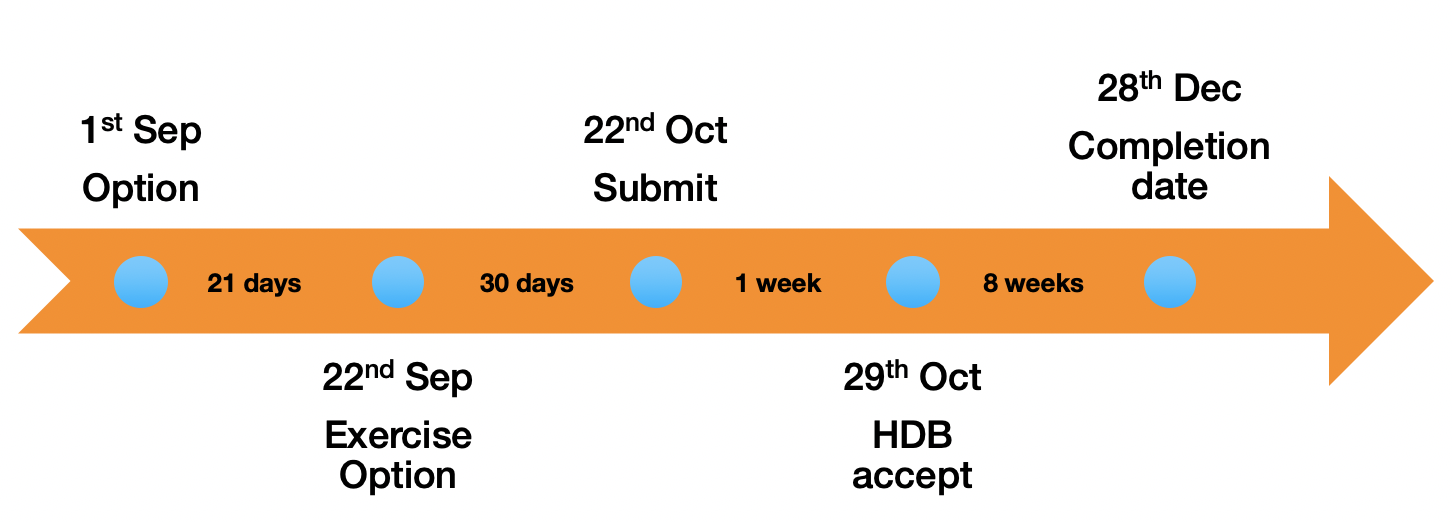

ECF or commonly known as Contra can be a challenging process to grasp. Contra is described as the selling of your existing flat and using the cash proceeds to finance the purchase of your new flat. Our agents explained the ideal timeline to accomplish contra while meeting its time-sensitive requirements.

An example of a contra timeline:

All in all, the seminar was chockful of helpful lessons for homebuyers who wish to embark on their property journey! Like our Facebook page and be updated with our upcoming seminars. Download Ohmyhome app now and post your listing. If you’re not keen on a DIY property journey, you may engage our HDB Resale Agent Service.

Related posts:

- Property with D & Z Episode 1: CPF Rule Changes

- Property with D & Z Episode 2: Changes in the Re-Offer of Balance Flats Scheme (ROF)

- Property with D & Z Episode 3: Pros and Cons of Buying a BTO

- 6 Things You Need to Do When Viewing a Property

- CPF Housing Grant: How to Save When Buying Your First Home