Are you thinking of selling your private property and buying an HDB flat as your subsequent home?

Finding the right home can be a challenge, especially when dealing with private and subsidised housing in Singapore. Rules and regulations are often a source of frustration as sellers and buyers navigate the complicated journey of figuring out if they meet the eligibility requirements or if they’ve considered all the important factors.

But no more. In this article, we’ll be exploring the various reasons people consider selling their condo and buying an HDB flat:

Table of Contents:

- Reasons why do people sell their condo and buy and HDB

- Factors to consider when selling condo and buying HDB

- HDB eligibility conditions

- Cannot buy BTO or take HDB loan

- Can buy resale HDB flat, but need to sell within six months

- Financial planning

- TDSR and MSR rules

- CPF rules to buy HDB flat

- Buyer’s Stamp Duty

- No need payment for ABSD, SSD and/or resale levy

Why do people sell their condo and buy an HDB flat?

Difference in priorities and needs

For example, an older couple with an empty nest has different needs from a younger, newly-wed couple.

Empty nesters, parents whose children have grown up and left home, may choose to sell their condo and move into a smaller HDB flat. Not only will it be more suitable for their new lifestyle, but it will also be easier to maintain and finance, especially with the Silver Housing Bonus (SHB) scheme.

Older, married couples might want a smaller HDB flat compared to a newlywed couple who may want a condo that’s better-suited for their lifestyle.

Newly-wed couples, on the other hand, will have only begun the process of family planning. As they envision a future with children, they may consider selling their condo for a larger HDB flat. Having extra space that can later be converted into a bedroom, nursing room, study room, or playroom is essential in creating a home fit for an expanding family.

Saving for retirement

As older homeowners reach retirement age, continuing to pay a sizable home loan may provide too much financial strain. As such, they can consider selling their condo and buy an HDB flat for a lower mortgage each month and channel their savings into their retirement fund.

Financial strain

It’s no secret that condos have higher upkeep costs compared to HDB flats. While condo residents share the burden of paying for the development’s monthly maintenance fees, some might find it:

- Redundant if they don’t personally don’t use the amenities

- Too expensive after adding up all the miscellaneous fees

A condo’s average monthly maintenance fee is estimated to be about $250 while service conservatory charges for HDB flats range from $65 and upwards*.

*You can check the full amount of your service conservatory charges with your Town Council.

Investment opportunities

Location versus property type is a relevant factor when discussing the housing process, as most savvy buyers will choose the former over the latter.

They may decide to sell their condo located in a non-mature neighbourhood for an HDB flat in a better location — an essential aspect of what is considered ‘prime’ residential property.

For example, homes near public transportation or schools, shopping centres, grocery stores, and key economic centres have higher rental yield and capital appreciation. It brings homeowners in a better position to reap financial gains from leasing or selling their HDB flat after reaching the 5-year Minimum Occupancy Period (MOP).

Which do you prioritise when looking for a home? Good location or property type?

Wherever you land in the scenarios mentioned above, you need to watch out for 7 things when selling your condo and buying an HDB flat after.

What to consider when you sell your condo and buy an HDB flat

The Housing Development Board, more commonly known as HDB, has some of the most confusing and strictest regulations for buying or selling property. If you are staying in a condo right now and are planning to sell it and buy an HDB flat, here are the important factors to take note of:

1. Eligibility to buy a new or resale HDB flat

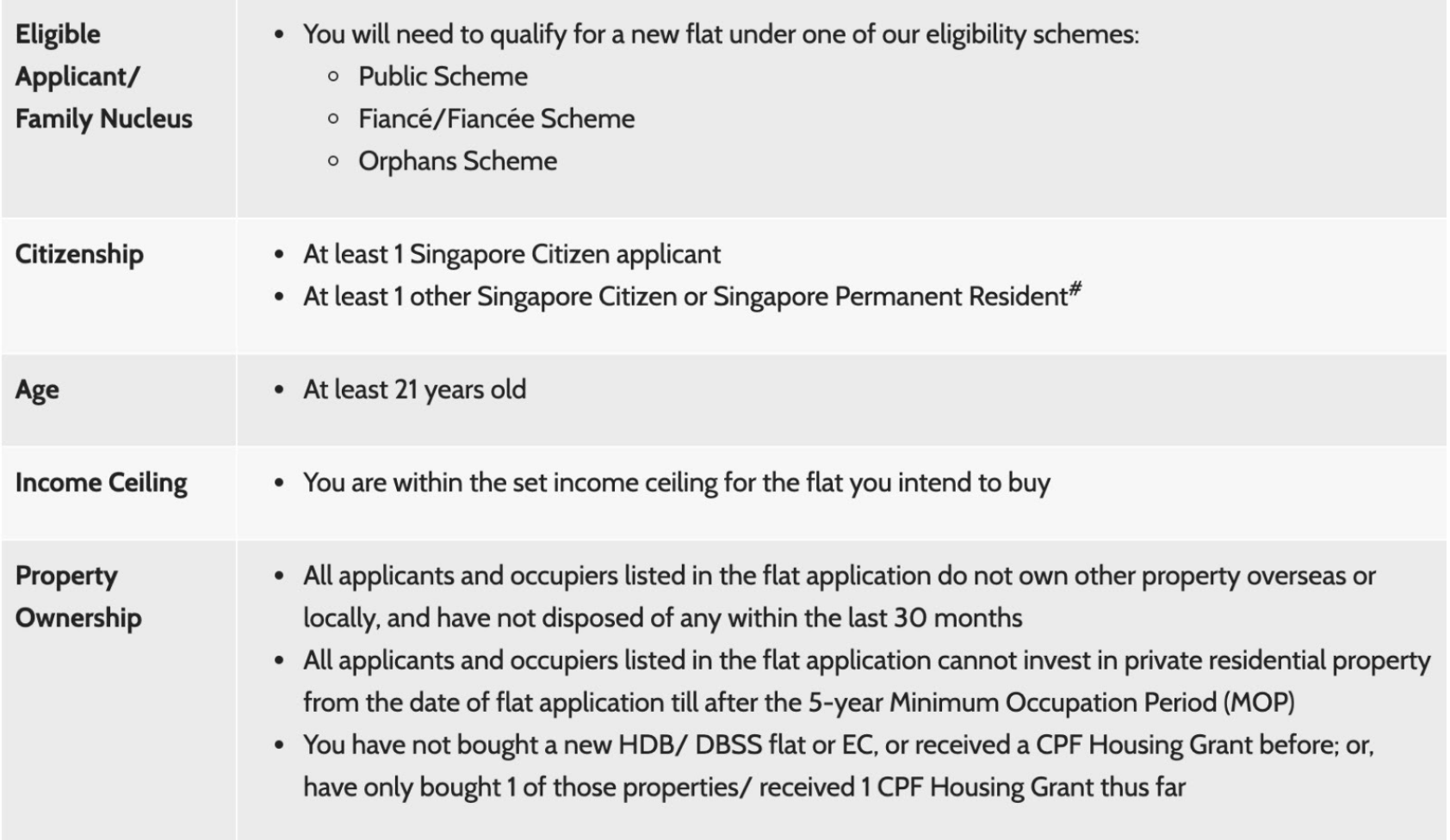

First and foremost, you will need to meet HDB’s eligibility conditions before you can buy an HDB flat, be it new-Buy-to-Order (BTO)-or resale. It includes citizenship, age, family nucleus, Ethnic Integration Policy (EIP) and SPR quota, income ceiling, and other special conditions related to the housing grants by CPF or the HDB.

For three-room BTO flats or bigger:

Source: HDB

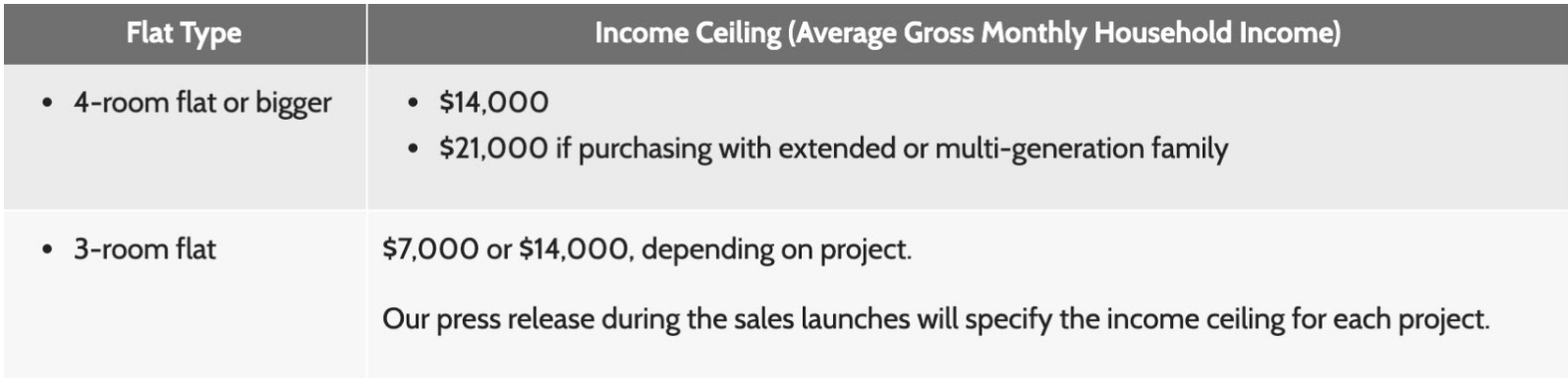

Income ceiling for three-room BTO flats or bigger:

Source: HDB

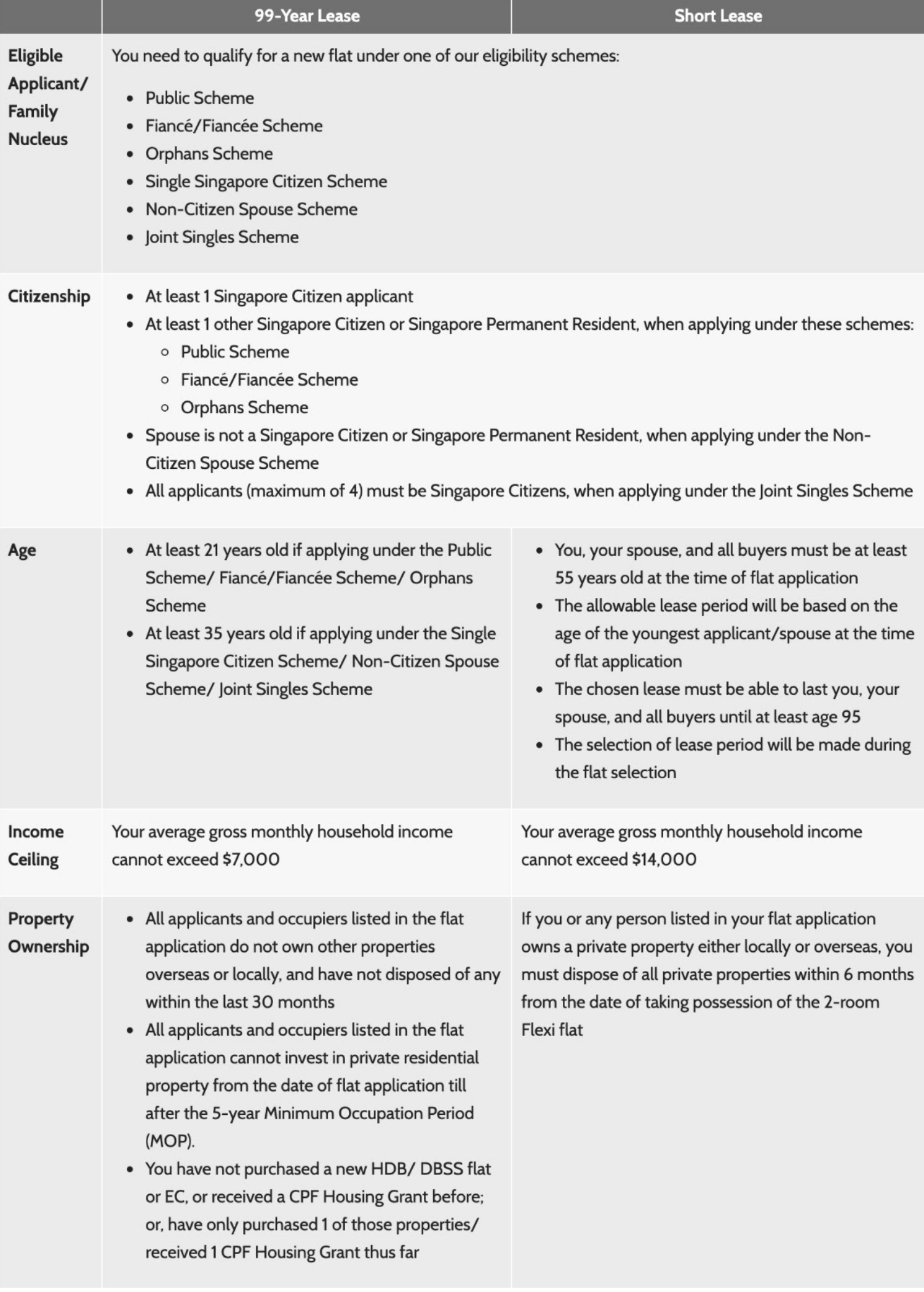

For new two-room flexi flats:

Source: HDB

2. Cannot buy BTO or take HDB loan

For a minimum of 30 months, starting from the date you sold your private property, you are not eligible to:

- Buy a BTO

- Buy an Executive Condominium (EC)

- Apply for CPF Housing Grants

- Secure an HDB housing loan

With a BTO purchase, you may need to rent a unit as you wait for the 30-month period to be over. After which, you will have to ballot for a BTO and wait for a few years to get your keys.

If you’re willing to wait for your BTO flat, then this is for you; but if you’re looking for a home you can move into immediately, consider buying a resale HDB flat instead.

Can buy resale HDB flat, but need to sell within six months

After selling your private property, you are allowed to buy a resale HDB flat. Note this caveat, though: You need to sell your private property within six months of your flat purchase.

That means you can buy a resale flat even before selling your private property, so long as you sell it within six months. You can also take a bank loan to finance it.

Whichever of the two you choose depends entirely on your timeline and financial planning.

3. Financial planning

Every home purchase is dependent on the right financial planning.

a. Pay your outstanding loans

Speaking of financial planning, make sure you pay off any existing or outstanding loans on your private property. This will help you immensely with how much you can loan for your new home.

b. 3-month notice period (more common with bank loans)

If you took a bank loan for your private property and are paying it off early, make sure to give them a 3-month notice. If you provide less than three months of notice, they may charge you a hefty fee for the shortfall in the notice period. It can amount to anywhere between $3,000 to a percentage of your outstanding loan, depending on the bank.

c. Lock-in clause (more common with bank loans)

If the loan package you took for your private property came with a lock-in clause, you might have to bear the penalty for refinancing your home loan before the period ends. The penalty is typically around 1.5 per cent of the outstanding loan amount, but do note that it may vary depending on which bank you choose. You can check it in your Letter of Offer.

d. Loan-to-Value ratio

The maximum loan amount you can get will depend on your age, loan duration and property type, and most importantly, if you have existing home loans. According to the Monetary Authority of Singapore (mas), LTV limits vary depending on the number of home loans the borrower already has.

LTV limits for loans on residential properties where the Option to Purchase (OTP) is granted on or after 6 July 2018:

| Outstanding home loans | LTV limit | Minimum cash downpayment |

|---|---|---|

| None | 75% or 55% | 5% (for LTV of 75%) 10% (for LTV of 55%) |

| 1 | 45% or 25% | 25% |

| 2 or more | 35% or 15% | 25% |

The table above shows that you can get a higher loan amount if you sell your private property before buying a flat. It is because you would have no properties under your name at the time of buying, which also means you would have no outstanding home loans.

4. Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR)

The TDSR and MSR protect borrowers from overextending themselves for their monthly loan repayments. Essentially, the TDSR and MSR limit the amount of money that can be withdrawn from the gross monthly income to pay off monthly mortgages.

Here’s a quick recap of what TDSR and MSR refer to:

- TDSR: The portion of a borrower’s gross monthly income that goes towards repaying the monthly debt obligations, including the loan being applied for. It can be a combination of car loans and housing loans, etc. Under the current TDSR rules, borrowers may only use a maximum of 60% of their monthly income for monthly loan repayments.

- MSR: The portion of a borrower’s gross monthly income that goes towards repaying all property loans, including the loan being applied for. The current MSR regulations limit borrowers to using a maximum of 30% of their monthly income for monthly loan repayments.

Don’t forget about the Income Weighted Average Age (IWAA)

Your mortgage increases as you grow older, which means it’s highly important you factor it in when doing your financial planning with your Super Agent.

It’s also important to note the IWAA, which takes a couple’s combined age and income to calculate the amount of their monthly mortgage payment.

The basic idea is that your mortgage increases as you grow older. Hence, it’s important to factor this in the home selling and buying process.

5. You can still use your CPF to buy an HDB flat

When you sell your private property, you can still use the CPF monies you returned to your account (with accrued interest) for your HDB flat purchase.

As of 10 May 2019, you can withdraw up to 100% of the market value or the property’s purchase price from your CPF account, whichever is lower.

The youngest owner must also live up to 95 years of the property’s leasehold, or the amount of CPF available for withdrawal will be prorated.

6. You will need to pay Buyer’s Stamp Duty (BSD)

BSD is the tax payable on all property purchases, be it residential, commercial, or industrial, calculated based on the property’s purchase price or market value, whichever is higher.

Take note that BSD rates vary depending on the purchase price or market value of the property.

7. No need to pay Additional Buyer’s Stamp Duty (ABSD), Seller’s Stamp Duty (SSD), or Resale Levy (conditions apply)

- ABSD: The tax levied on your second or subsequent property, based on the percentage of your purchase price or valuation, whichever is higher.

If you buy a second property, you’ll first need to pay the ABSD as usual, within 14 days of completing the sale. Married couples, however, can apply for a remission if they sell their first home within six months of buying the second one.

For example, if a married couple’s first home is a condo and they decide to move to a resale HDB flat, they’ll have to pay the ABSD within 14 days of buying the flat. After which, they can apply to get their money back once they have sold their private property within six months of the next home purchase. (Two important things to remember: The couple must remain married at the time they apply for the remission and haven’t bought more properties before the application.)

New laws from 9 May, 2022 with regards to residential properties transferred into a living trust:

Additional Buyer’s Stamp Duty (ABSD) of 35% will now apply on any transfer of residential property into a living trust. ABSD will be payable even if there is no identifiable beneficial owner at the time the residential property is transferred into a trust.

- SSD: The tax payable to IRAS on all properties sold within the three-year holding period.

You will only need to pay SSD if you sold your property within the three-year, minimum holding period. That means you need to live in your home for at least three years before you can sell it without incurring SSD.

- Resale Levy: The cost that would be incurred from buying a new flat, intended to reduce the subsidy on the second subsidised flat.

This is only applicable for those buying their second, subsidised property. If the first property you’ve owned is private property, then the Resale Levy does not apply to you. But if you have owned a subsided property from HDB before, you will need to pay a fixed amount to the Board as a Resale Levy, depending on the size of the flat you’re buying.

Avoid making costly mistakes in your housing journey. Get professional assistance from real estate salespersons who can help you with all the necessary financial calculations, timeline planning, home loan comparisons, and everything else you need to make a savvy decision.

Looking for an HDB or private property?

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home buying decision, so you no longer have to spend hours searching online for the information that you need. Because at Ohmyhome, we’re always by your side, always on your side.

You can message us in the chatbox at the bottom, right-hand corner of the screen to secure an appointment with any of our Super Agents.. You can also WhatsApp us at 9755 1009!