Property investment is a more secure, long term investment compared to other types of investments, such as the volatile stock market, which is more speculative. And although it is harder now for property investors to make a profit, with all the restrictions and cooling measures imposed by the government, investing in property remains to be favoured in Singapore.

But property investments require certain factors to be considered. So, before you sign your name on your next property, we encourage you to ask yourself these five questions:

1. Am I eligible to buy?

If you are buying another HDB flat, eligibility is a key starting point. If you live in a new or resale HDB flat, or an Executive Condominium (EC), you cannot buy a second property until you’ve fulfilled the five-year Minimum Occupancy Period (MOP). This means you are required to stay in your home for the duration of those five years before you can purchase your next or second property.

2. What type of property am I looking for?

The type of property you intend to buy will greatly determine the next steps you’ll need to take.

Examples of property types:

- HDB – from a two-room flexi to an executive flat

- Design, Build, and Sell Scheme (DBSS) flats

- Executive Condominiums (ECs)

- Condos

- Apartments

- Semi-detached or terrace houses

- Good Class Bungalows (GCBs)

Considerations before buying a second HDB flat

If you are buying an HDB flat, you need to check your eligibility under the Ethnic Integration Policy (EIP) and Singapore Permanent Resident (SPR) quota.

Dive Deeper: 7 Factors to Consider When Buying Residential Property in Singapore for SC

You are also required to sell your property within six months after receiving the keys to your second HDB flat.

3. What are key factors to consider when choosing the right property?

Whether you’re buying a second property as an investment or to live in it, you need to consider these four factors:

1. Location

Where your property is located will greatly determine the type of tenants you’ll attract. If it’s located in the Central Business District (CBD), you’ll attract more expats looking to rent near their workplaces.

For owner-occupiers, the location of your second property will determine your lifestyle and community. Purchasing a home in Orchard means you’re closer to the hustle and bustle of the city, which can mean a faster pace of living. Out in the heartlands, you’re surrounded by a majority of family units in a community where the pace of living is slower.

2. Surrounding developments

What are the amenities within the vicinity of your second property? Are there transportation networks nearby? These factors can also determine the type of tenants you’ll attract.

As an owner-occupier, you also need to determine if the surrounding amenities fulfil your domestic needs. Are there supermarkets close to home or, if the second property is for your elderly parents, hospitals and clinics? If you have children, the schools nearby can also make or break your decision.

3. Upcoming developments

It’s always a good idea to check the Urban Redevelopment Authority (URA) to see if they have any upcoming plans for the area your second property is located in.

Where your property is located will greatly determine the type of tenants you’ll attract.

A good example is URA’s plan to transform Jurong East into Singapore’s second Central Business District (CBD). From the cluster of malls housing major retail chains to the Kuala Lumpur-Singapore High Speed Railway, we can expect a bigger rush of property buyers in the Jurong area.

4. Rental Rate

Like other investments, you’ll need to figure out the potential rental yield and capital appreciations, as well as the estimated return on investment.

You can also check the average rental rates in an area over time (about five to ten years), to determine how well the rental rates perform as the years go by. If the rates are falling, your second property may not fare any better.

A general rule of thumb here is that the rental rate covers, or even exceeds, the monthly loan repayments for the property you just sold.

Dive Deeper: 4 Things to Consider When Renting Out Private Property in Singapore

4. If it’s an investment, is it the right time to buy?

However, with any investment, there are risks involved. Expats are leaving the country as the government enforces tighter foreign curbs, driving a decline in the country’s population since 2003, pushing rents lower.

Don’t forget about the Total Debt Servicing Ratio (TDSR)

If you’re planning on buying a second property as an investment, and considering getting a home loan, you need to remember the TDSR, which ensures borrowers are not overleveraged on debts. It is a standard that applies to home loans in Singapore, granted by financial institutions.

Dive Deeper:

- Should You Borrow More? Total Debt Servicing Ratio and Your Housing Loan

- Mortgage 101: What is Total Debt Servicing Ratio (TDSR)?

5. Can I afford a second property?

Finally, you need to work out the costs involved in buying a second property to find out if you are financially equipped to do so.

Loan-to-value (LTV) Ratio

After the government announced the latest round of the property cooling measures, The LTV for bank loans is now 75%. If purchasing a second property the LTV is 45%, or 25% if the loan tenure is longer than 30 years.

Additional Buyers’ Stamp Duty (ABSD)

Due to rising prices and volume of transactions, the government introduced the latest round of property cooling measures in December 2021.

For Singapore Citizens, the ABSD for a second property is 17% of the purchase price or value, whichever is higher. For Permanent Residents, it’s 25%, and 30% for foreigners.

New laws from 9 May, 2022 with regards to residential properties transferred into a living trust:

Additional Buyer’s Stamp Duty (ABSD) of 35% will now apply on any transfer of residential property into a living trust. ABSD will be payable even if there is no identifiable beneficial owner at the time the residential property is transferred into a trust.

So this new change closes a loophole. This ABSD (Trust) is to be paid upfront when the transfer is made.

Property Tax

During the Singapore Budget on February 18, 2022, the government announced that the Property taxes rates for both owner-occupied and non-owner-occupied residential properties will be revised in 2 steps starting from 2023.

Rates for owner-occupied homes with an annual value in excess of $30,000 will be raised – ranging from 5 to 23 percent in 2023, to 6 to 32 percent in 2024.

For non-owner-occupied homes, which includes investment properties – taxes will be hiked across the board: from the current 10-20 percent, to 11-27 percent in 2023 and 12-36 percent in 2024.

In conclusion, you need to be financially prudent when buying your second home in Singapore, as it is capital-intensive. If you miscalculate any part of your home purchase, you might be in for some financial trouble. As such, we recommend you determine a clear plan with a financial planner to help you with potential blind spots.

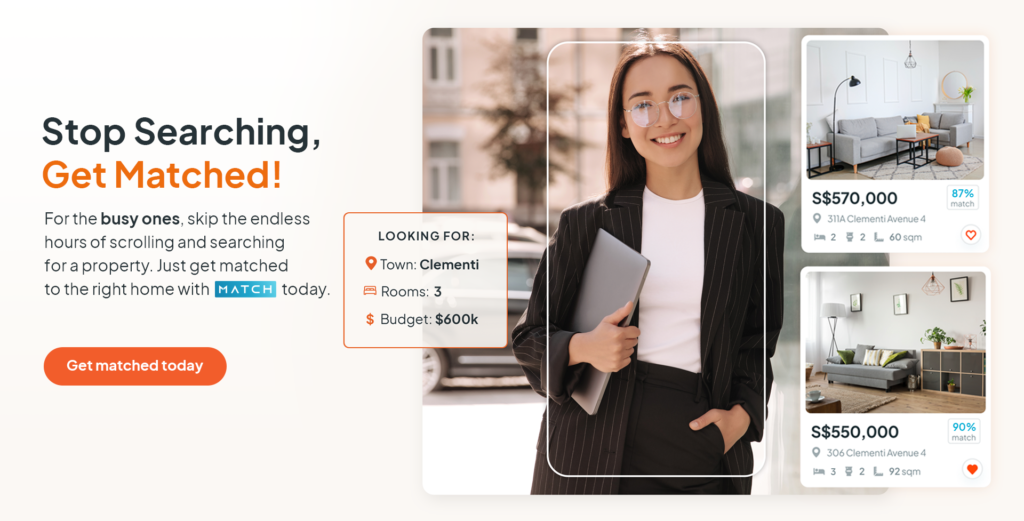

Looking to buy a new condo?

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home buying decision, so you no longer have to spend hours searching online for the information that you need.

Experience seamless, fast and exceptional service from our Super Agents. Chat with us at the bottom, right-hand corner of the screen. Or WhatsApp us at +65 9727 5270 to get in touch.