An older version of this article from March 2021 is available here.

Though restrictions have been easing up and we’re witnessing the dawn of a new era where COVID is treated almost as dismissively as the common flu, we foresee some COVID-inspired interior design trends that are here to stay.

1. A Zoom room

The Zoom Room is just pandemic speak for a really swell, pimped-out home office you can show off on video calls without having to resort to a virtual background to hide the unsightly state of your now very lived-in home. A Zoom Room isn’t necessarily an actual room. For those of us with shallow pockets and deep creativity, a Zoom Room could easily be a designated corner or room in your home with a “curated background” that just so happens to fit into your video call frame so you always look work-ready in your meetings.

These spaces are decluttered and set away from communal parts of the house, so you never have embarrassing moments of a child screaming in the background or an elderly grandpa wandering across the screen in his boxers. Although most offices are now back in full force, we foresee homeowners keeping a “Zoom Room” ready in their homes in case of an unexpected lockdown. It also makes an alternative high-productivity area for the times when you need to work from home on weekends or after hours.

2. Neutral palettes

There is only so much character we can take from a room we live and breathe in day after day. With the two lockdowns we have experienced, many homeowners and interior design professionals now truly understand the meaning of getting “stir-crazy” and the need for an environment with a clean, simple palette.

More homeowners are now opting for cleaner colour palettes in home designs, with “comfort” and “timelessness” being key considerations in their colour picks for their living spaces. Whites, creams, beiges, pale to darker grays, and other neutral tones remain popular options.

On the same note, the minimalist trend saw homeowners on a decluttering spree to make living spaces more livable; we foresee this trend will carry on post-COVID as we get used to seeing clean, open spaces within our homes.

Read more about home renovation and interior design:

- 5 Home Renovation Concerns All Homeowners Worry About

- 2022 Feng Shui Tips to Invite Good Fortune Into Your Home

- How to Choose the Right Sanitary Fittings When Remodelling Your Bathroom

- How to Renovate Your Resale HDB Flat: Timeline and Procedure

3. Not mixing work and play

Move over, open-concept homes. COVID saw homeowners and designers swapping out open-plan spaces for purposefully-designed ‘cocoons’ that offer privacy and focus, and with larger communal spaces that serve as ‘break areas’, to cater to clearly defined work and play environments. Having clear “sections” and rooms also became crucial for those sharing a house with a family member with COVID or under quarantine.

Rooms that were dedicated to playtime, also helped keep the kids away. Many homeowners child-proofed their homes or designed playrooms to keep the children within confined play zones, allowing a space where the little ones can go crazy, even draw on blackboard or whiteboard laminated walls, to unleash their creativity and hopefully expand all that boundless energy.

4. Let there be light

As more and more of us got increasingly used to working from home, the need for brighter, lighter spaces became a necessity.

As new technologies pop up, promising to mimic daylight, complement mixed design themes, or enhance various moods, increase productivity or promote better sleep, homeowners have begun to see lighting as key to home design. Gone are the days when a single light switch controlled one austere light bulb that was supposed to provide all the light in a single room. These days, a mix of overhead lighting, standing lamps, and mood lighting are combined to create highly livable and convertible spaces to cater to changing needs.

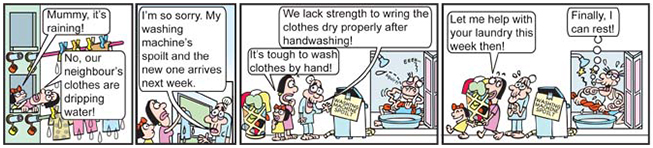

5. Material matters

Interior design trends are witnessing a massive rise in the demand for furniture and surfaces made of sustainable, low-maintenance materials. Choosing low-maintenance materials like quartz countertops (no staining, scratch-resistant) in place of high-maintenance, porous materials like marble, or picking composite materials (no bloating, no rotting) instead of actual wood, means less cleaning. Throw in the fact you may be sharing a home with sticky-fingered children or an adult who hasn’t gotten the hang of “adulting” and you will find a low-maintenance home can go a long way in preserving your sanity.

Need a home makeover? Ohmyhome Renovations is here to turn your vision into reality!

Renovation not just improves the overall value and aesthetic of your house, but it allows you to enjoy your home to the fullest and incorporate a part of yourself into the spaces around you. So sit back, relax and let us turn your house into a home, because at Ohmyhome, we’re always by your side, on your side.

Engage our experienced team of interior designers and contractors for a well-executed home renovation project. Call us at 6886 9009 to secure an appointment with any of our Interior Designers or message us in the chatbox at the bottom, right-hand corner of the screen. You can also WhatsApp us at 9755 9283! Or get a free quote for your home in seconds!

Read about these Instagram influencers’ homes and interior design inspirations: