Marketing is the lifeblood of any business — even real estate. That’s why you need to know how to market your property listing in order to get it out there and increase your chances of selling your home, because the more people you can reach, the better your chances are at finding a ready buyer.

It’s not that complicated either; the marketing of a property listing should be the same as the marketing of any other product.

Think of Nike. They’ve marketed their products so well that, at one drop, buyers flock to their stores to cop the latest pair of, say, Jordans. It’s not like there are no competitors in the market, though.

You’ve got the likes of Adidas, Puma, and New Balance fighting for the attention (and wallets) of sneakerheads, yet Nike remains at the top of buyers’ minds when they want a trendy, comfortable, and functional pair of shoes. Whether they’re an athlete or your regular Joe.

But how do you build such a high level of awareness and reach among buyers that, no matter how saturated the market is, you can attract the right property buyer to your listing?

Here are five marketing tactics you can do right now to list your property like a pro:

1. Market your property listing as soon as possible

You know what they say, the early bird catches the worm. So if you’re a hungry bird, the quickest and easiest way to catch a worm is to be where it always goes. In this case, that’s a property search platform.

With Ohmyhome, you can list your property for free! Simply download the app on App Store or Google Play to get access to over 20,000 users — one of whom can very well be the buyer you’ve been waiting for.

On the other hand, if you engage a property agent to sell your home, you’ll have access to even more potential homebuyers.

More often than not, the property industry is governed by who you know more than how much you know. And as professionals whose living is to sell properties, property agents would have a wide network of co-brokers and potential homebuyers. And they can easily send a message or two about your listing and immediately get enquiries from their buyers in return.

Another thing: If you engage an Ohmyhome agent, your listing will be posted on all the top property platforms, including PropertyGuru, 99.co, and SRX. It will also be boosted on all platforms, for higher exposure and reach.

Your listing will, of course, be posted on the Ohmyhome website and app.

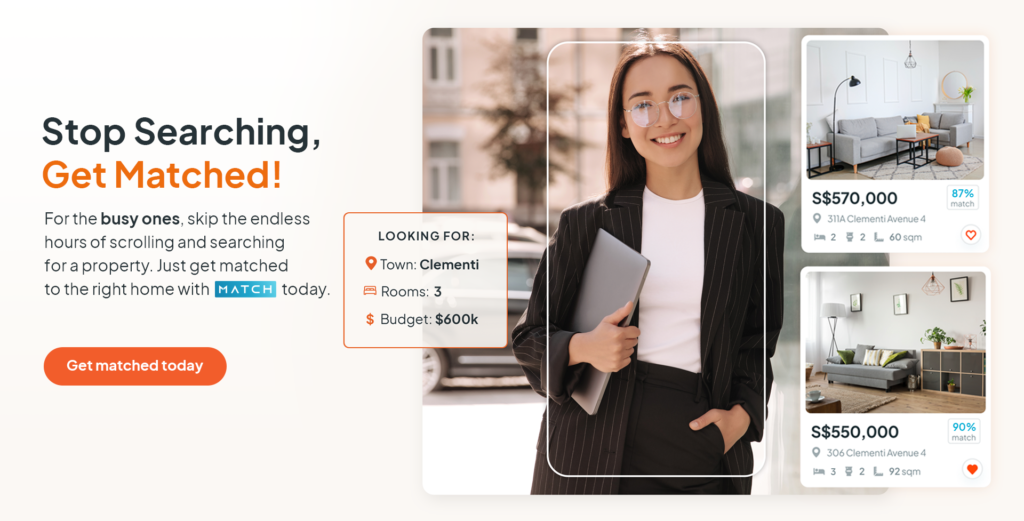

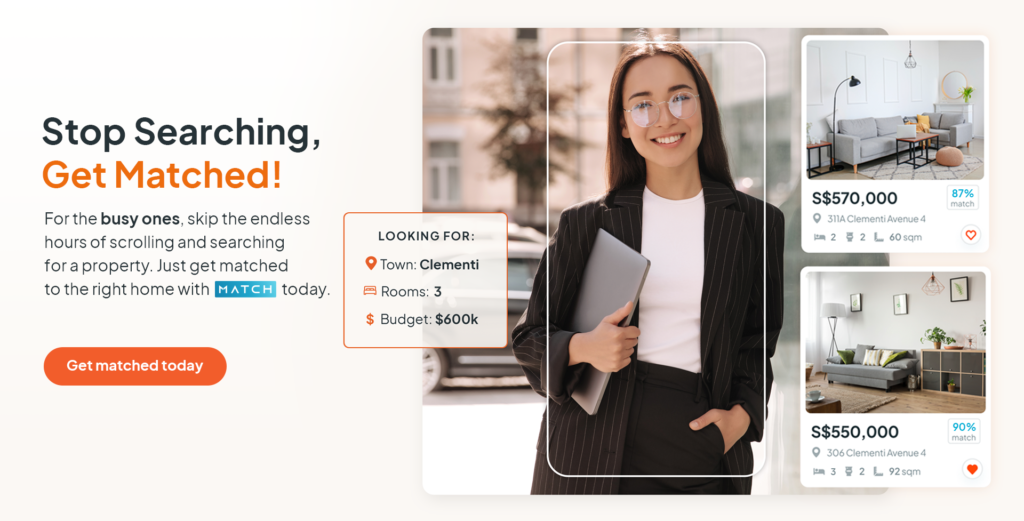

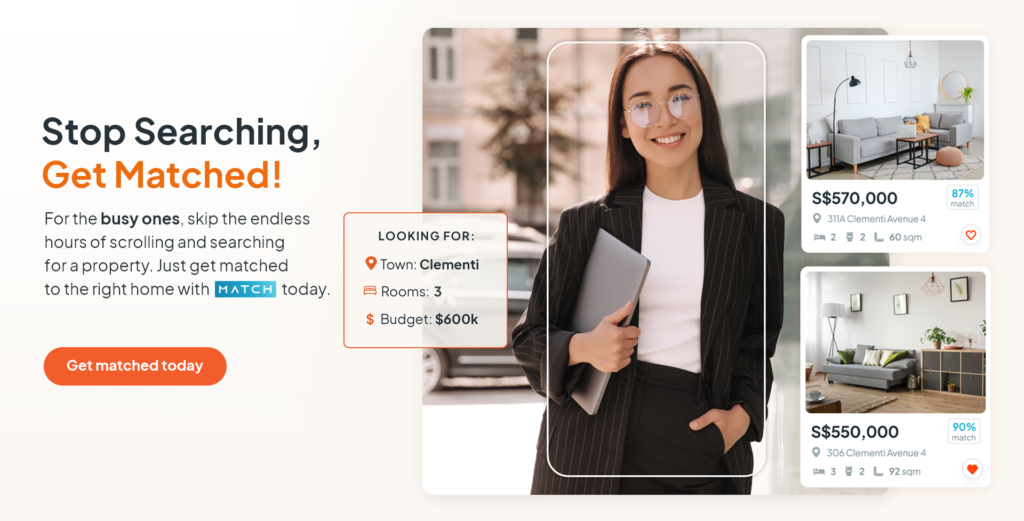

We will also send your listing to potential homebuyers via WhatsApp, thanks to our data-matching algorithm. You can learn more about it here.

2. Optimise your listing with Search Engine Optimisation (SEO)

Most homebuyers today are tech-savvy and educated. From our interview with several homebuyers, they will conduct their research online before committing to a purchase. This lets us know that Google is a battleground you need to be fighting on.

The way you, the seller, gets your listing in front of buyers’ eyes is through SEO, which helps a website or web page rank higher on a search engine like Google to drive more traffic to your site. In this case, SEO will help your listing (which, if you followed Tactic #1 above, will be on a property listing platform) show up at the top of a Google search results page.

So how do you do that?

When listing your property, it’s all about using the right keywords. What do buyers search for when they’re searching for a property?

You may have a better understanding of what buyers search for than you may think because, if you’re selling a property, then you’re most likely in the market for a new home as well. Take some time to perform a keyword search on Google and type different variations of ‘homes for sale‘, like ‘HDB resale flat for sale woodlands’ or ‘Woodlands HDB listing for sale’.

With Google’s autocomplete function, you’ll immediately find the most-searched terms that buyers use, which will be the right set of keywords to use for your listing.

Click any search result and you’ll see how other websites use SEO to rank higher on Google’s search results pages.

If you can master the basic SEO best practices, you stand a better chance at reaching more buyers, and the easier it will be for you to track the responses to your listings.

Once you get the hang of it, you can adjust your listing descriptions and images for better results.

With the right keywords, your listing page can rank higher on a search engine like Google so you can remain top-of-mind among property seekers.

Conducting keyword research will also help you get to know your target buyer better. Besides, if you’re selling a property, then you’d probably be in the market for a new one as well, so you know the kind of information a buyer such as yourself will want to know. With that in mind, you can include every sellable detail in your listing.

Some basic unit details that you’ll need to fill in any property listing platform include:

- Address – Did you know that, on Ohmyhome, you can now auto-fill your property address and verify your listing via SingPass?

- Property type – Is it an HDB flat, a condo unit, or an apartment?

- Year of completion – When was your property completed?

- Floor size – How big is your property?

- Tenure – 99-year or freehold?

- Sale price – How much are you selling your property for?

Here’s what a home listing for sale will look like on Ohmyhome:

We’ve included a field for sub-property type for you to further detail if, as shown above, it’s an Executive Condominium, which is technically still considered under HDB.

There’s also a field for you to fill the Ethnic Quota available in your HDB block, further filtering buyers who are actually eligible to buy your property.

Remember: a good listing description contains all the information that buyers are interested in knowing and blends it with SEO best practices.

For example, this Ohmyhome listing:

- Denotes that the listing is special and fresh by using the words ‘exclusive’ and ‘new’

- Reiterates the sale price in the beginning, usually the first thing that buyers will ask for

- Highlights USP #1: The unit has undergone the Home Improvement Programme

- USP #2: The area is quiet!

- USP #3: Within walking distance to public transportation

- USP #4: Close to amenities for your daily necessities

- USP #5: Proximity to schools

3. Make an impactful first impression with good listing images

Think of your listing as your first impression to your buyers. How do you want them to perceive your home? Do you want to invite them in or turn them away?

If you’re selling your home, we’re sure you want to invite them in. This is how you do that.

To invite buyers to connect with your home on an emotional level and inspire them to imagine themselves living in it, your listing photos have to sell the lifestyle they envision for their future. Is it understated luxury they’re aiming for?

Lucky for you, if you hire Ohmyhome, you get a property agent who’s trained in the basics of property photography and is assisted by an in-house marketing team with professional photographers to:

- Highlight the space of your home through different angles

- Declutter so your unit looks clean and organised in the listing

- Find the best lighting to accentuate the interior design of your flat

- Adjust elements in your home, such as furniture, for a more aesthetic look

Take a look at this photo, taken by Ohmyhome’s in-house photographer, for a now-sold $1 million resale HDB flat in Toa Payoh. It highlights the space of the home and the open floor-plan concept from an angle from which you may not have thought of taking the picture.

The space is also free of clutter and the decor they do have are arranged neatly. It may look like your average HDB flat, only the furniture is arranged just so and the floors are gleaming, showing off the marble — it’s spick and span and each piece is in its rightful place.

If photos speak a thousand words, then your listing should be saying, This is the home of your dreams. And you can do that with Ohmyhome on your side.

4. Create a striking video that sells a lifestyle, not just a property

While a listing image is absolutely necessary when you’re posting a listing on a property platform, a video is not as important. But it is more impactful.

Here’s how you can create a great video tour when selling your home:

See, you can’t just sell your property. You also have to sell a lifestyle — the kind of life they’re already envisioning in their heads, and the life they can aspire to if they live in your home. In your neighbourhood.

And the best way to sell a lifestyle today is through a video.

The reason why brings us to our next point…

5. Leverage social media to spread the word about your listing

The rise of social media — namely, Facebook, YouTube, Instagram, and more recently, TikTok — has shaped the way we consume content and buy products, even one such as real estate. And since its conception, these platforms have paved the way for video to become the best medium for property advertisements. The success of a certain group of property agents is proof enough that it’s true. And it works.

Today, agents have found various ways of selling a home. On TikTok, you’ll find smooth, gliding home tours of luxury apartments with every beat of trending audio dictating the flow and cut of the video.

On YouTube, an in-depth home tour that shows you every nook and cranny of a property while also highlighting its unique selling points: Show your target buyer what makes your home special!

Does it really have a rare high ceiling that’s rare in Singapore?

Or is it located in a well-connected neighbourhood where public transport is easily accessible, highways are nearby, and amenities are within walking distance?

Social media is your best friend when it comes to promoting your listing in this day and age. A Facebook post or Instagram story will bring your listing into the direct eyesight of buyers.

And if you follow the marketing tactics mentioned above, you can catch their attention, draw them into clicking your listing, making an enquiry, and eventually, an offer that you can’t ignore.

We’re sharing all this with you to keep you updated and better informed on the best ways to market your listings, or how property agents market usually market theirs. Whether you engage an agent to sell your home or not, it’s good to know the lay of the land so you won’t be shortchanged.

But if you’d rather leave the marketing of your property listing — and the selling of your home — to actual licensed professionals, Ohmyhome is your best bet.

Sell your home fast and at the best price with Ohmyhome!

Sell your home for a high price in no time, hassle-free. Our Super Agents are CEA-certified and among the Top 1% in Singapore. With more than 180,000 happy customers served, we’ve garnered 4-star ratings on both Facebook and Google! Because at Ohmyhome, we‘re always by your side, always on your side.

Call us at 6886 9009 to secure an appointment with any of our Super Agents or message us in the chatbox at the bottom, right-hand corner of the screen. You can also WhatsApp us at 9755 9283!