Article 2 – Test article for ES

Author: Ohmyhome

Don’t Get Haunted – 5 Dos & Don’ts During Hungry Ghost Month – dev_website

Gian Paolo Gicaraya – – This is a sample change

The Southeast Asian Chinese are pretty superstitious. From avoiding the number “4” (which sounds like the Chinese word for “death”) and lauding the number “8” (a homophone of the Chinese word for “prosper”), to a host of other things they have to look out for during different festive seasons or observances, they tend to adhere to these practices even if they don’t quite buy or understand them.

Especially when it comes to the Lunar Seventh Month, better known as the Chinese Hungry Ghost Festival. That’s when their level of superstition skyrockets to a mildly paranoid level.

During Hungry Ghost Month, it is believed the gates of the underworld open to release all the spirits of the dead, much like a holiday month for them, where they are free to roam the earth. Unlike Halloween though, celebrated with trick-or-treats, the Hungry Ghost Festival is regarded with much reverence —and a healthy dose of fear — as they observe some eerie superstitions to avoid offending or crossing paths with wandering spirits.

Below, we go through a few property-related superstitions homeowners may want to look out for during this period.

1. Do take in your laundry before the sun sets

It is ill-advised to hang your laundry out overnight to dry during this period. There are several superstitions tied to this. One belief is that smoke from burnt offerings may cling to your laundry, causing it to smell of incense, which may attract wandering spirits. Another is that damp clothing attracts spirits to “try on” your clothes and “follow” you into the house.

Both ideas are equally spine-chilling but, logically speaking, it is rare for anyone to hang their laundry out overnight, given that our unpredictable weather is prone to sudden showers and storms in the middle of the night. Morning dew is also counter-effective in drying your clothes and may give them a “dank” stench from the moisture.

If you have the habit of hanging out laundry overnight due to an overly hectic work schedule, you may want to invest in a good dryer or switch out your washer for a washer-cum-dryer if space constraints are an issue. Now you can luxuriate in the joy of always having freshly laundered clothes that are properly dried.

2. Do hold off the renovations

Legend has it that you will anger resting spirits with the noise created through home renovation during this month. Other beliefs include renovation processes going awry, or workers inexplicably getting injured in the process of carrying out renovation works.

Home renovations during Hungry Ghost Month can still be carried out, but you may want to keep a strict schedule and have all reno works end well before sunset.

This also helps you avoid angering your resting neighbours, which could go a long way in ensuring you are welcome in your new neighbourhood. Besides, general renovations in HDB flats are only permitted to occur from Monday to Saturday, between 9 am and 6 pm.

Read Also: How to Renovate Your Resale HDB Flat: Timeline and Procedure

3. Don’t leave your door open at night

While we don’t personally know anyone who does this despite Singapore being one of the safest countries to live in, we’d still like to remind all our beloved homeowners to keep their main doors closed and locked at night. Besides wandering spirits, an open door is an invitation for crime and ill intentions and does not bode well in Feng Shui either as it allows yin energy — which is the strongest at night — to enter your home.

If you have the habit of forgetting to shut your main door or to lock in, consider getting a door with an auto-close and auto-lock function. A cheaper option, instead of replacing your entire door, would be to install a self-closing door hinge and install a digital lock that automatically bolts your door when it is fully closed so you never have to worry about intruders, human or spectral.

4. Don’t move into a new home

Moving into a new home during Hungry Ghost Month comes with the eerie belief that you may find yourself with unwanted housemates — and we’re not talking about pests for which you can call in an exterminator. There are several ways to circumvent this.

While the most obvious method is to simply wait out the Hungry Ghost Month and move in after, there are also “cheat codes”, such as doing a “false move-in” before the Chinese Seventh Month begins.

You could get your contractor or designer to quickly complete the main bedroom, or at least have it in a relatively livable condition and stay one night in it before the Seventh Month. You could also cook a pot of rice in your kitchen as a declaration that you have “officially moved in”, so when you do actually take up residence during the Seventh Month post-renovations, it is taken that you have been living in the house all along.

5. Do get professional advice on purchasing new property

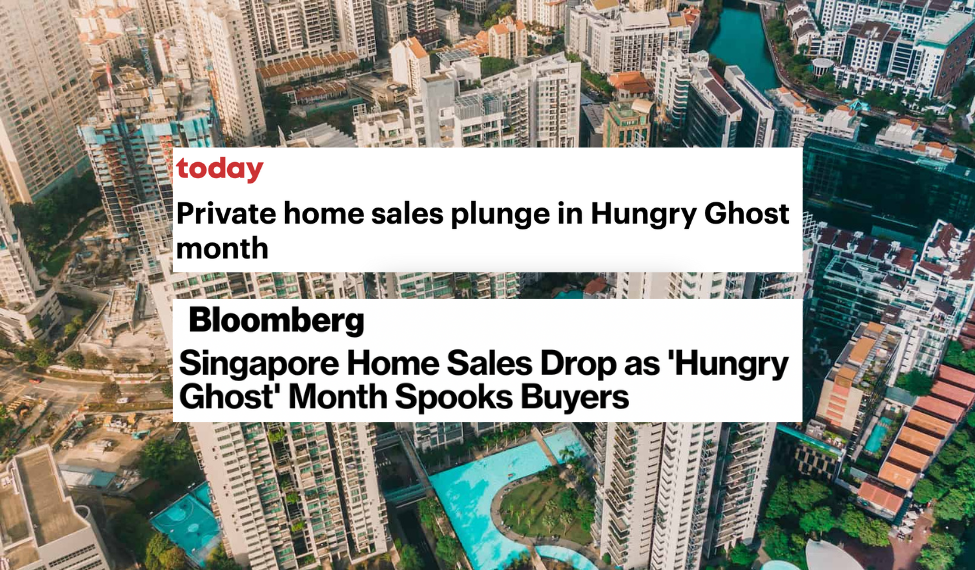

In previous years buyers have held off on buying a new property during Hungry Ghost Month. Reports showed that new private home sales fell drastically during Hungry Ghost Month in 2016. This could also have been due to developers pushing back project launches due to the inauspicious sentiments tied to the season.

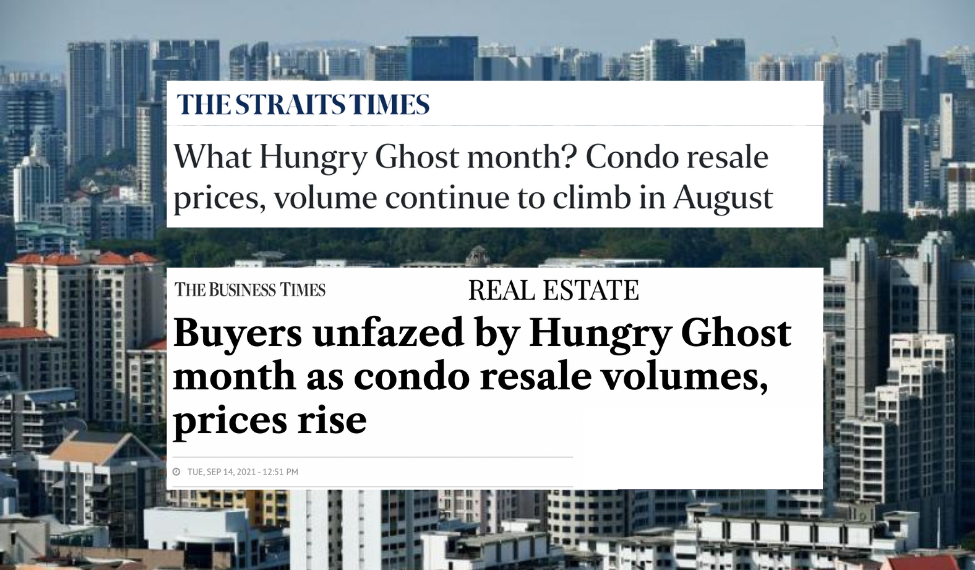

However, in recent years, new launch sales have remained robust, and even taken an upsurge during Hungry Ghost Month as superstitions fly out the window, likely due to the combination of low supply of available properties as well as pent-up demand from buyers. In August of last year, the Business Times reported that private property resale volume rose despite it being Hungry Ghost Month.

Alternatively, you could also get a Feng Shui master to help you select an auspicious date to complete your property purchase. If you are looking to invest in a new property, getting a new launch that has yet to TOP may just be a win-win situation for you. Property transactions may be known to dip during this month as investors or new homeowners avoid purchasing new property, but new launch sales could still remain robust depending on the housing market at the time. But also, with the stretched completion timeline of new launches, you may even land yourself a good deal if developers decide to launch special promotions to drive sales during what they may fear is a “lull period” for sales!

Regardless of your beliefs, Ohmyhome is here to help you make prudent home buying decisions that will benefit you and your family!

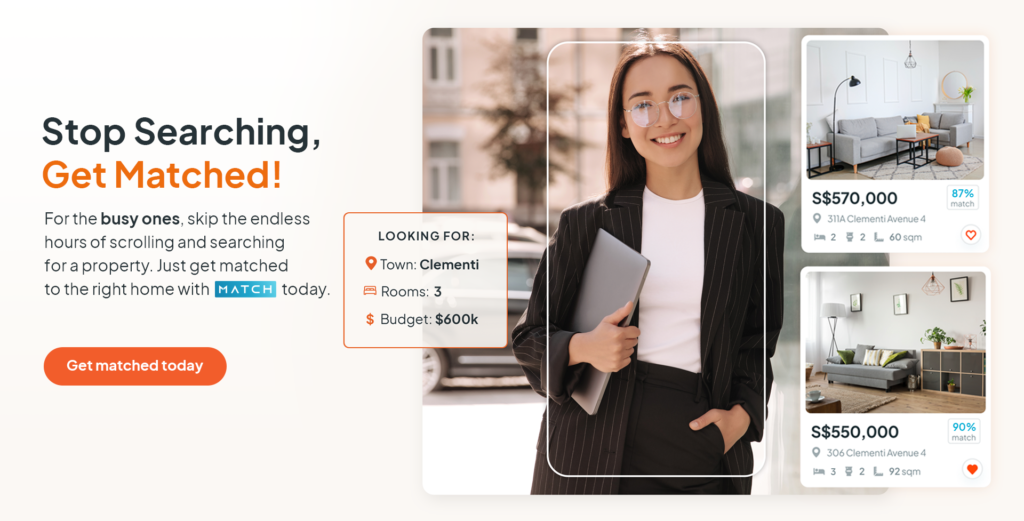

Looking for an HDB or private property?

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home buying decision, so you no longer have to spend hours searching online for the information that you need. Because at Ohmyhome, we’re always by your side, always on your side.

You can message us in the chatbox at the bottom, right-hand corner of the screen to secure an appointment with any of our Super Agents.. You can also WhatsApp us at 9755 9283!

We even have feng shui practitioners on our team who can help you make prudent decisions on when and how to purchase your new home during this period!

Frequently asked questions about Hungry Ghost Month

What is the month of the Hungry Ghost?

The seventh month in the Lunar Calendar is regarded as Ghost Month. The Hungry Ghost Festival is celebrated on the fifteenth month of the Lunar Year, which falls on 12 August 2022.

How long is the Hungry Ghost Festival?

The Hungry Ghost Month festivities last for 14 days; from July 29 to August 26 2022.

What not to do during Hungry Ghost Month?

Homeowners are advised to not hang their laundry overnight, hold off on home renovations, and moving into a new place, to name a few dos and don’ts.

3 Benefits of Living in the City (Updated 2022)

Gian Paolo Gicaraya – – This is a sample change

Whether its non-residential sites like the Paya Lebar Airbase, older neighbourhoods like Ang Mo Kio or even less accessible areas like the Jurong Lake District, the Urban Redevelopment Authority’s (URA) residential development plans for the next 50 years will be taking jobs, transportation and other essential facilities into the four corners of Singapore.

This decentralisation was already in the works prior to this decade, but was accelerated by a prolonged period of mandatory work-from-home arrangements owing to the COVID-19 pandemic. Which begs the question: If all Singapore towns become as accessible and connected as the central region, is it still worth it to pay a premium for properties there?

If you’re looking to buy or rent a home in the Core Central Region (CCR), the question of whether living in the city is still worth it might have crossed your mind.

The short answer? Yes.

Living in or close to the CBD still comes with major perks unique to the central region. Even as Singapore’s property landscape continues to transform, there will always be something about the CBD that other neighbourhoods can’t quite replicate — and we’ll be breaking down what exactly makes the city centre so distinct in this article.

Read Also: URA Reveals Housing Plans for the Next 50 Years

Where exactly is Singapore’s city centre?

Officially, the CCR refers to districts 9, 10, 11, the Downtown Core and Sentosa. As you may know, this is where the nation’s most prestigious residential properties tend to be found. Mixed-use developments and good class bungalows are commonly found in the area, located close to lifestyle and retail districts such as Orchard Road and of course, Sentosa Resort.

And contrary to the Central Business District (CBD) that’s filled with tall, concrete office buildings that results in high foot traffic, and noise pollution, there are actually plenty of private residences that provide personal space and tranquillity in the CCR!

If you’re looking at getting your hands on property in any of these regions, you’ll have the following to look forward to:

1. Always within reach of essential and recreational facilities

Living in the CCR means always being just a few stops away from three essential aspects of life in Singapore: good jobs, good food and good entertainment.

Nearly every MRT station here is an interchange that links to at least two other lines. If you’re going to the prime shopping district of Orchard, you can easily stream into the North-South Line from the North-East Line or Circle Line via Dhoby Ghaut MRT, or the East-West Line via City Hall MRT or Raffles Place MRT. Everything else in between is either accessible by foot or can be reached within a quick bus ride.

That said, residents living outside the central region are also receiving upgrades to their transportation networks. For example, Punggol residents will be able to reach Pasir Ris in just three MRT stops once the Cross Island Line is completed in 2030. Similar developments across the island mean that public transport networks will soon be just as dense elsewhere as they are in the city centre.

However, the CCR still retains its edge over other neighbourhoods due to its reputation of being where Singapore’s most affluent residents have been living for the longest time. Businesses and developers have spent decades setting up retail and recreational offerings in the area, so that CCR dwellers won’t have to travel out of town to find something to keep them entertained. Additionally, since the Cross Island Line and other public transport upgrades are still in the works, the CCR continues to beat other neighbourhoods in terms of convenience and connectivity. At least for now.

2. Save time and money

On a related note, the connectivity within the CCR allows you to avoid a significant portion of the morning rush hour. The convenience is such that you may even opt to go without a car. Don’t underestimate the amount of savings you can make with that. After considering road tax, Electronic Road Pricing fees, parking, petrol and insurance, owning a car in Singapore can cost you upwards of $200,000 over the course of 10 years.

Therefore, though residential units in the CCR often come at a premium, the hours shaved on daily commutes and savings you make on private transport might actually make the higher price point worth it.

Furthermore, the aforementioned decentralisation of the CBD might actually be a good thing. As high-paying jobs are scattered over the country, you may find that you’re able to get on with your day quicker as lunch crowds and road traffic thins. Lesser foot traffic also means that facilities in the area will have less competition, and require less frequent maintenance, too.

3. Good property investment potential

Buying a home in Singapore has always been regarded as one of the safer ways to invest. And considering the recent volatility of the stock market, downturns in alternative portfolios such as cryptocurrency as well as the threat of a looming global recession, real estate remains to be one of the few assets that continue remaining stable during this period.

The limited availability of space in the CCR means that property buyers and investors are always looking for opportunities to lay their hands on a coveted unit in the area. Should you find yourself in a position to sell your CCR property further down the road, chances are that you’ll have many takers who are willing to buy your home at a favourable price.

Furthermore, URA’s plans to incorporate living elements such as mobility-friendly features, green spaces, convertible public areas and lifestyle essentials into the downtown area will also stimulate growth value in CCR properties. The CBD’s reputation as a ghost town after office hours may soon be a thing of the past, and you’ll find yourself with plenty of things to do and places to explore when you’re done with work.

Finally, CCR’s long-held reputation as the A-list of local properties also means that residential units here have a high chance of retaining their value, even as developments around the island continue to spring up. Older office developments may also be converted into mixed-use residentials after renovation, offering a unique alternative to what’s already on the CCR market.

Looking for private property?

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home buying decision, so you no longer have to spend hours searching online for the information that you need. Because at Ohmyhome, we’re always by your side, always on your side.

You can also call us at 6886 9009 to secure an appointment with any of our Super Agents or message us in the chatbox at the bottom, right-hand corner of the screen. You can also WhatsApp us at 9755 9283!

Powering Up Our Tech! Prioritising Security for Our App Users

In 2016, Ohmyhome launched with an app that helped you buy and sell homes easier and faster.

In the years since, we’ve included plenty of features that made the initial promise easier to fulfill.

And as usual, we only keep improving.

In August this year, Ohmyhome will be rolling out a new in-app chat update that creates a safer environment for all users on our app.

We’ve doubled down on security and made that our utmost priority by:

- Introducing fraud detection measures that flag out suspicious behaviours on the marketplace by blocking phrases and sentences typical scam artists use.

- Removing the “Make An Offer” feature, which we’ve identified as one of the functions abused to pressure users to send money to what they believe to be a legitimate process and request in buying or viewing a home.

- Implementing read receipts to ensure that a user always knows the buyer or seller’s level of engagement. In a chat conversation, you can now see if the other party has read your message.

- Adding push notifications for the chat function so that you’re notified when you receive a reply. This means you end up buying, selling, renting, or leasing your home much quicker, saving precious time, and likely closing at a better deal.

- Promoting an environment to keep the entire conversation you have with an interested party within the app (it’s much safer to keep Chats on Ohmyhome).

Important note for active users:

1. (For all users) All closed and completed chat history sessions will be removed, but conversations with active listings will remain.

2. (For Singapore app users only) The appointment setting function will also be removed, but only temporarily. A new and improved version will be introduced soon.

This will be a mandatory update so you will have to ensure you’ve updated the app to its latest version before you can continue using it.

We’ll remind you as the days get closer.

If you have yet to download our app, today is still the best day to do so. Put the power and knowledge of buying or selling your home in your hands. Feel free to click the image to your respective app stores below to download the app.

We’re looking forward to making sure your experience with Ohmyhome continues to be a pleasant one and we’re excited to let you know what else we have in store to make your homeowning experience even simpler and safer.

While the Information is considered to be true and correct at the date of publication, changes in circumstances after the time of publication may impact on the accuracy of the Information. The Information may change without notice and Ohmyhome is not in any way liable for the accuracy of any information printed and stored or in any way interpreted and used by a user.

How To Calculate Your Cash Proceeds From Your Home Sale

Congratulations! Your home has hit the 5-year Minimum Occupancy Period (MOP) and now you’re able to sell your home to reap the profits from your purchase.

It’s an exciting time, and you’re already picturing the lump sum of cash that will enter your bank account once the whole process is over.

But now you’re wondering to yourself…

“How much do I actually get IN CASH after the sale?”

That’s a great question, and we’re here to answer it.

Join me and let’s do the math (one step at a time) to figure out your home sale.

The main factors we need to look at are the following:

- Sale price of your home

- Outstanding loan

- Refund of CPF OA used + Accrued interest

- Property agent fee

- Legal fee

- HDB resale fee

And profit!

So, here’s how to calculate!

Let’s say, you purchased a 4-room BTO at $400,000, 5 years ago.

With this in mind, you placed a 10% downpayment of $40,000 using your CPF and took a HDB loan of $360,000 at 2.6% per annum (p.a.) for 25 years.

As a result, that means your monthly mortgage repayment amounts to $1633.21 per month, and you decided to service the entire monthly mortgage using your CPF OA as well.

Still following along? Great. Let’s continue. (Now with formulas!)

After 5 years, your property has appreciated by 25% and grown to $500,000. A $100,000 profit — great success!

While technically correct, let’s see exactly how much you can take home in cash.

After 5 years of paying your loan, your $360,000 loan is now at $305,393.93.

As shown above, you may be wondering why after paying close to $98k, your loan principal only reduced by $54.6k. Well, that’s because only a portion of the monthly payment reduced the principal. The rest was paid to interest.

The next step is to calculate your CPF OA refund. Take note that this will be paid back to your CPF OA, not given in cash.

After using $40,000 for your downpayment and servicing your entire monthly mortgage with your CPF OA, you now owe yourself $149,585.07.

To calculate this, we use a financial calculator to find the future value of your CPF with Accrued Interest owing. You can download an app to try this for yourself or use Microsoft Excel to input the Future Value (FV) formula to find the same results.

Great. Next, you were smart to engage Ohmyhome’s Super Agent to sell your home. To reward them for their hard work at finding you a buyer who agreed to your ideal sale price, you pay a low market rate of 1% service fee + 7% GST. This amounts to $5,350.

Let’s combine the last 2 assumptions: Assuming you engage HDB’s legal services, using their helpful Legal Fees Enquiry Facility, it’ll cost you $290, with an additional resale fee of $80.

Let’s punch in the equation, shall we? (we’re almost there).

Sale price – Outstanding loan – Refund of CPF OA used with acc. interest – Property agent fee – HDB legal fee – HDB resale fee = Cash in bank

$500,000 – $305,393.93 – $149,585.07 – $5,350 – $290 – $80 = $39,301.01

To sum up, a $100,000 profit translates to…

$39,300 cash in your bank account.

“But what if I want MORE?!”

We want to help you with that.

There are 3 ways to help you earn and keep more profits in cash:

- 1) Sell your home for a higher price

- 2) Reduce your mortgage interest rate (refinancing)

- 3) Don’t use all your CPF

1) Sell your home for a higher price

This may be the most obvious solution, but it’s perhaps the hardest to achieve. The best ways to achieve a higher selling price boils down to a few factors:

Better staging of your property

There are just some things you cannot physically change. Your home’s location and its size. However, staging could help you overcome pesky “flaws” in your property.

Staging your property is the art of beautifying your home for pictures. The first thing most people see when looking at a property listing are the pictures.

Before price.

Before nearby schools.

Even before the closest amenities.

The look of the home is the reason why an interested buyer may continue to care and consider buying your home.

You don’t need to be a world-class photographer or an award-winning designer.

Just an eye for highlighting natural light and space could already win you 90% of the battle for attention.

Ohmyhome’s Super Agents are trained to do exactly that. With an average transaction of 120 HDB homes in a year, they’ve seen it all. Even smaller homes with an intimate setting can be staged to look spacious and welcoming.

Aggressive marketing

In simple economics, demand drives prices. The more people want it, the more valuable it becomes.

This is the same for your home.

Attracting more individual buyers, having the opportunity to get them to outbid one another, and closing at a higher price just to swat away other parties would certainly help you increase the sale price of your home.

However, for many of the property listing sites, you need to be a property agent yourself before you can list your home.

Another option you may have is to run advertisements and get interested buyers to contact you directly. But it comes with heavy costs that eat into your potential profits, without even considering the time you’ll have to set aside to entertain every inquiry and arrange viewings whether they’re genuine or just window shopping.

The alternative? Ohmyhome.

Ohmyhome, until today, remains the only property tech solution that allows homeowners to list their homes for free. And you can download our app here.

Our MATCH solution then pairs buyers — who have input the type of properties they’re looking for — with you, if there’s a match.

You’ll get notifications as quickly as an 18-year-old heartthrob who just joined Tinder (ah, the good ol’ days).

Real buyers with genuine interest, notified immediately.

Other agents may claim they have ready buyers for your home, but we actually have proof.

Persuasive negotiation

Finally, bringing out the inner Jordan Belfort. Remember that guy in Wolf of Wall Street?

You want to sell high, and they want to buy low.

If you want to sell your home at a higher price, you’ll have to convince your buyer that it’s worth the price.

Remember, if you’re selling your home above valuation, your buyer will have to pay a Cash Over Valuation (COV) in cash.

That’s a big commitment for them and requires expert negotiation for you to pull off.

Ordinarily, we don’t expect many homeowners to be able to do so, and that’s why it’s proven that having a seasoned property agent with years of experience could add an extra 5-15% on average in the sale price.

Here are just some examples.

Ohmyhome does it day-in-day-out, and we regularly update our latest transactions to show you how successful we are at selling homes above average transacted prices.

2) Reduce your mortgage interest rate

Your next biggest culprit in reducing your cash profits is the interest rate you’re paying.

If you were to get a mortgage rate of 1.8% p.a instead of 2.6% p.a with a bank loan, you’ll be:

- Saving $142.14/mth or $8528.61 over 5 years,

- Reducing your loan balance by $5,057.83 as more is paid to principal than interest,

- Using less CPF OA and accrued interest by $9,074.52,

- And increasing your overall cash proceeds by $14,132.35.

Altogether, that’s an extra 36% of cash profits from one little trick.

Now, we understand that as of writing, interest rates have flown through the roof. But when interest rates fall in the future, be sure to refinance your mortgage to get a better deal and to earn a higher profit overall.

Ohmyhome provides mortgage services as well, so do keep us in mind.

And last and most controversially,

3) Don’t use all your CPF

I feel like I’m going to be burned at the stake here, but the numbers don’t lie.

While your CPF OA is returned to you and you can immediately use it again for your next purchase, the double whammy of not earning interest from the government and instead paying yourself that interest is a painful pill to swallow.

From our calculations above, if you would have used cash for both the downpayment and the monthly mortgage, you would have paid $138k instead of $149k.

That’s an extra $11k that you would earn directly through your CPF interest rate from the government.

And all that $138k is returned to you in cash to use however you please.

Now, we’re not advocating for you to just use cash. In fact, that’s close to impossible for most Singaporeans.

We’re just here to present the facts and it’s up to you to decide. Perhaps a combination of both?

Let’s put it all together

If you followed our tips and…

- Sold your home for 5% more earning you an extra $25,000.

- Reduced your interest rate from 2.6% to 1.8% earning you an extra $14,000.

- And used cash instead of CPF earning you an extra $11,000.

You’ll be walking home with $50,000 in additional profits — more than doubling what we started with.

How does an extra $89k sound to you?

It’s a brand-new car, or buying your next house a few floors higher, or even paying the university tuition of your future child.

Well it sure sounds good to me.

Let us help you achieve this when you sell your home.

All you have to do is to drop us a call, message us on Whatsapp, or fill in a callback form and we’ll get back to you in 15 minutes.

Set up a meeting with our property agents and get your home-selling journey to the best start.

To more profits and a smoother experience!

5 Things You Need to Know Before Hiring a Renovation Firm (2022)

An older version of this article published in 2019 is still available here.

It is always a good idea to do a little homework before embarking on your home renovation journey. Not only will it help you be more prudent with your budgeting, but you may also learn a few neat tricks to get your money’s worth. Knowing how the timeline and budgets work also will help you keep an eye on the renovation process so you know what to expect at each “milestone” of your renovation, which could trim off unnecessary wait times in between each mini-project of your home makeover. Below, we delve into a quick guide on choosing a good home renovation company.

1. If you can’t gel, it’s not going to go well

Whoever you choose to work with should instantly get you and your ideal design in mind. Rapport between you and your designer is crucial, and if your designer doesn’t seem to get what you want, or seems to keep taking you in a different direction, you could consider getting a second opinion. In fact, we highly recommend shortlisting at least three firms so you can compare quotations, interior design styles, and assess their work ethic before picking one that best suits your needs. After all, this is going to be your home for the next few years at least.

Unless the interior designer is giving you enlightened advice on not installing certain frills in your home that may be high maintenance, or getting wall-to-wall built-in carpeting when you have a pet in the house, your renovation company should be able to fulfil your requirements and desired style within reason.

It’s a good idea to browse through portfolios of your shortlisted renovation companies. Ask detailed and technical questions on the kind of materials that will be used, the timeline they are proposing, and a full breakdown of costs, and be thorough on your research, before you sign any documents. Renovation loans can cost you years of expensive monthly instalments, which is a terrible burden to bear if you’re not getting your money’s worth.

2. Be wary of rotten reviews

While forum reviews are pretty ambiguous, if a renovation company has been called out online, we strongly suggest you exercise caution and do your research before considering taking them on for your home renovation project. Negative reviews can be highly subjective, and good design firms can be brought down by irate customers with unrealistic expectations.

As such, your safest bet is to use a renovation company recommended to you by a trusted friend or acquaintance, making sure it has all the proper accreditations and licences, checking up on their backgrounds and reviews, and ensuring the company does not have a high turnover rate and has been in existence for some time. Designers that disappear, or contractors checking out of the project mid-way; who needs stress like that in their lives?

You can even ask for references, so you know the company actually has a repertoire of happy customers.

3. You have to know what’s what

In the course of your renovation, your contractor will likely have to secure permits, licensing, approvals, and the like.

Knowing exactly what documents you will require for your renovation will go a long way in making sure your contractor doesn’t try to “smoke” you with non-existent “waiting periods” in an attempt to hide renovation delays.

Knowing what permits are involved also helps you recognise if your contractor is truly experienced. Having the right permits will avoid future issues with inspections and safeguard the resale value of your home.

4. Stick to your budget

Before reaching out to renovation companies, it’s important to come up with a budget range that you can spend and highlight it to the designers. Depending on the scope of work and your design ideas, most renovation companies can work within the budget given. High-quality or premium materials will cost more, and in turn, will raise the costs of your renovation.

Your designers should be able to advise you on suitable material substitutions to achieve the overall look you desire. With the plethora of material choices available in the market these days, it is a breeze to find materials for your home that may cost less, while providing you with the convenience of lower home maintenance and improved sustainability in the long run.

Making separate lists of what you need versus what you want, helps you separate the non-essentials from the basics. A good renovation company will provide you with a detailed breakdown for every single cost — inclusive of items, specifications, the materials used, and the timeline of installation — so you can keep track of your budget and eliminate any unnecessary add-ons.

5. Tying up loose ends

A good company should have a clear payment schedule, which should never involve full upfront payments before the job is completed. That is a serious red flag for renovation scams.

Before making the final payment, ask your renovation company to review each project on the detailed quote and check thoroughly to see if the work has been satisfactorily delivered. A reliable contractor or designer will highlight any defects to you before you even spot them, so you have accountability and a promise from them to touch up or make good on the flaws, if there are any.

One last tip: Don’t be afraid to ask questions if anything looks incomplete or if the clean-up was shoddy. Take note that renovation companies usually provide chemical cleaning before key handover to ensure that you can move in the day after. While you may want to mop the floors for an extra shine or run over your carpentry with a rag again, your new home should be move-in ready at the handover point.

Want to find a reliable renovation company?

Ohmyhome Renovations is here to turn your vision into reality!

Renovation not just improves the overall value and aesthetic of your house, but it allows you to enjoy your home to the fullest and incorporate a part of yourself into the spaces around you. So sit back, relax and let us turn your house into a home, because at Ohmyhome, we’re always by your side, on your side.

Engage our experienced team of interior designers and contractors for a well-executed home renovation project. Call us at 6886 9009 to secure an appointment with any of our Interior Designers or message us in the chatbox at the bottom, right-hand corner of the screen. You can also WhatsApp us at 9755 9283! Or get a free quote for your home in seconds!

What You Need to Know About the Lease Buyback Scheme (LBS) – Updated 2022

Can you make money from your HDB flat while living in it? Is there a way to make an income from your property without renting it out?

The answer to both of those questions is: Yes, under the Lease Buyback Scheme (LBS).

What is the Lease Buyback Scheme?

The LBS allows you to sell part of your flat’s lease back to the Board and use the proceeds to receive a bonus that can be your stream of income during retirement.

Are you eligible for the LBS?

You must meet these requirements to qualify for the scheme:

| Criteria | Eligibility |

| Age | 65 years old or older |

| Citizenship | At least one owner must be a Singapore Citizen |

| Gross Monthly Household Income | $14,000 or less |

| Flat Type | All flat types, except for short-lease flats, HUDC and Executive Condominiums |

| Property Ownership | Must not be owning another property at the same time |

| Minimum Occupation Period | 5 years |

| Minimum Lease | At least 20 years |

Read Also: What You Need to Know About Minimum Occupation Period

So how does the LBS work?

Let’s say, you and your partner are both 66-year-old empty-nesters who own a fully-paid 5-room-flat, and it has a remaining lease of 65 years.

Under the Lease Buyback Scheme, you can choose to sell 35 years of your lease to HDB, keeping the remaining 30 years of the lease, and get a bonus! The LBS bonus depends on the type of flat you own, though.

Since you own a 5-room flat, the LBS bonus you will receive can be up to $7,500. 4-room flats, on the other hand, can receive up to $15,000 and $30,000 for 3-room flats.

In addition to the bonus, the proceeds will be used to top up your CPF Retirement Account (RA).

If there is only one flat owner, the RA top-up will be up to the current age-adjusted Full Retirement Sum (FRS). But for households with two owners, each owner will have to use his or her share of the proceeds to top up his or her RA to the current age-adjusted Basic Retirement Sum.

You can only pocket the cash left after you’ve topped up your CPF RA. You may retain up to a maximum of $100,000. But if there’s still some remaining proceeds after the top-up and setting aside of the $100,000 cash, you are required to use you and your co-owner’s share to futher top up your respective RAs to the current FRS before you can keep the remaining balance in cash.

How to determine your remaining lease period?

You can actually choose how long your remaining lease will be, according to the age of the youngest owner of the flat. The duration of the lease retained will determine the amount of net proceeds you can receive.

| Age of youngest HDB flat owner | Minimum lease retained | Other options |

| 65 – 69 | 30 | 35 |

| 70 – 74 | 25 | 30, 35 |

| 75 – 79 | 20 | 25, 30, 35 |

| 80 and above | 15 | 20, 25, 30, 35 |

Here’s how to determine the amount you need to top up to your CPF RA

This applies to applications received from 1 Jan 2022.

| Age of Flat Owner | Top-up Requirement for 1 Owner | Top-up Requirement for 2 or More owners |

| 65 – 69 | $192,000 | $96,000 |

| 70 – 79 | $182,000 | $91,000 |

| 80 and above | $172,000 | $86,000 |

How to calculate the amount of LBS bonus you can receive?

Your household will receive the full bonus as long as the total top-up to the flat owners’ RA is $60,000 or more. If you are unable to do so, you will receive a pro-rated bonus of:

- $1 for every $2 CPF top-up for 3-room or smaller flats; or

- $1 for every $4 CPF top-up for 4-room flats; or

- $1 for every $8 CPF top-up for 5-room flats or bigger flats.

So how can you actually earn money through the LBS?

Well, if you have at least $60,000 in your RA after the top-up, you can use those savings to buy a CPF LIFE plan, which will provide retirees with a monthly income for life. (Note: Those aged 80 years old and above are not eligible to join CPF LIFE.)

In summary, this is how the Lease Buyback Scheme works

| Step 1 | Sell part of your flat’s lease to HDB |

| Step 2 | Choose to retain the length of your remaining lease based on the age of the flat’s youngest owner |

| Step 3 | Receive a bonus of up to $30,000 for a 3-room or smaller flat, $15,000 for a 4-room flat and $7,500 for a 5-room or bigger flat |

| Step 4 | Use the net proceeds to top up your CPF RA |

| Step 5 | Use your RA savings to join CPF LIFE to receive monthly payouts no matter how long you live |

Why is LBS important?

Retirement funds – or the lack thereof – is a pressing issue in Singapore as more and more of the elderly population find themselves facing retirement without a financial safety net and/or insufficient funds in their CPF RA. The LBS was then introduced by HDB as a way to help seniors earn cash without parting ways with their beloved home. Homeowners who participate in the scheme can still rent out spare rooms for additional income.

Does Ohmyhome’s in-house property agent recommend it?

Our Ohmyhome CEA-licensed proeprty agent emphasised that the scheme will not necessarily benefit everyone’s circumstances. He explained that the LBS would not be an advantage for empty-nesters who are willing part with their home and right-size to a smaller unit.

However, it is definitely an avenue to consider should the discerning elders have chronic/mobility-restrictive conditions and/or formed a tightly-knit community amongst their neighbours that would prevent them from buying a new home.

He recommends that it is worth considering other possible options such as right-sizing to a smaller flat if you’re willing to relocate or renting out your property to tenants. After all, you won’t be able to put your flat on the market again after LBS.

If you need assistance with regards to the Lease Buyback Scheme, you can call HDB Branch Service Line at 1800-225-5432 between 8:00 am and 5:00 pm from Mondays to Fridays.

Planning to sell your old flat instead?

Sell your home for a high price in no time, hassle-free. Our Super Agents are CEA-certified and among the Top 1% in Singapore. With more than 180,000 happy customers served, we’ve garnered 4-star ratings on both Facebook and Google! Because at Ohmyhome, we‘re always by your side, always on your side.

Call us at 6886 9009 to secure an appointment with any of our Super Agents or message us in the chatbox at the bottom, right-hand corner of the screen. You can also WhatsApp us at 9755 9283!

Pollen Collection: New Landed Property at Nim Road

The five-year wait for landed property home buyers is finally over! The Pollen Collection by Bukit Sembawang Estates is the first government-sold site for landed homes since Lorong 1 Realty Park in 2017, and it presents a rare opportunity for multi-generational families to live under one roof while having sufficient personal space.

Located at Nim Road, in District 28, Pollen Collection comprises 132 units of 99-year leasehold 3-storey landed homes with an attic, including 106 intermediate terraces, 22 corner terraces and 2 pairs of semi-detached houses.

Renowned interior designers W Architects will be integrating the indoor spaces with outdoor living and dining spaces to let residents enjoy better views and air circulation.

Achievements by Pollen Collection developer Bukit Sembawang Estates

The project is highly anticipated by property watchers and buyers alike, especially given the impressive track record of the developers.

Bukit Sembawang Estates saw much success with their new launch project Liv @ MB, which occupies the former Katong Park Towers site in District 15. It sold over 75% of its 298 units on its launch weekend, at an average selling price of S$2,387 per square foot (psf).

Read Also: The Analysis Behind Landed Properties in Singapore

Just as Liv @ MB breathed new life into the old school neighbourhood, Pollen Collection is also expected to invigorate the hitherto stagnant local landed property market, which accounts for only 5% of housing units in Singapore.

Surrounded by expressways and transportation

Being a landed property, Pollen Collection’s accessibility is understandably not as good as other residential projects, be it condominiums or HDB flats, that have direct access to MRT stations or bus services. But it may not matter to potential homebuyers of Pollen Collection who are highly likely in possession of their own vehicles.

That said, there is some form of public transportation available nearby as bus stops aren’t actually too far off You’ll reach the ones along Yio Chu Kang Road and Ang Mo Kio Avenue 5 within 5-7 minutes of walking.

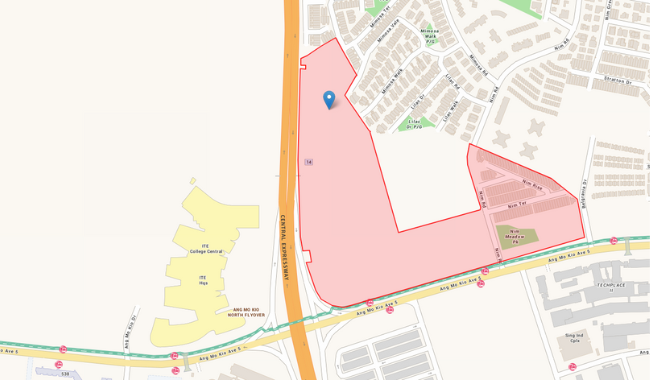

Pollen Collection is conveniently located on the fringe of Nim Road estate, off Ang Mo Kio Avenue 5. This puts you within mere minutes away from major expressways such as Central Expressway (CTE) and the future North-South Corridor (NSC). The CTE will provide you with a direct 25-minute path to the Central Business District. You can also expect your property’s price to appreciate once the NSC is completed in 2026, which will bring the northern neighbourhoods of Sembawang, Woodlands and Yishun even closer.

Speaking of future developments, Tavistock MRT of the Cross Island Line will also bring greater convenience to residents upon its completion in 2030 as it is only a 10-min drive away.

Always within driving distance of lifestyle malls

Flanked by Seletar and Ang Mo Kio, you will also have no shortage of food and retail options to help you unwind. Ang Mo Kio Hub can be accessed westwards within a short 14-minute drive, while Seletar Mall and Greenwich V can be reached within 7 minutes and 3 minutes by car respectively.

You may even choose to take a leisurely 16-minute stroll to Greenwich V to enjoy its chic cafe brunches in outdoor spaces surrounded by greenery that Pollen Collection residents of any age can enjoy. Proximity to Ang Mo Kio also means that you’ll always be one short drive away from treating your elderly parents to affordable, nostalgic meals such as Eng Ho’s classic Fried Hokkien Mee and Lao San Kway Chap.

An impressive line of educational institutions

Whether your children are starting their first few years of formal education or preparing themselves for university or the workforce, there are plenty of schooling options available for students of all ages. Buses 70 and 854 from the bus station after Dedap Road will take Rosyth Primary School students within walking distance of their school in about 34 minutes. The same alighting bus stop near Gracehaven S Army is also close to Bowen Secondary School and Xinmin Secondary School, both of which boast an impressive history of nurturing talented individuals.

Known for its award-winning Wushu and robotics program, Peihwa Secondary School can be reached within an 8-minute by drive or 11 minutes by bike. Bus 163 also offers a direct route to school after a 3-minute walk out of the landed property estate.

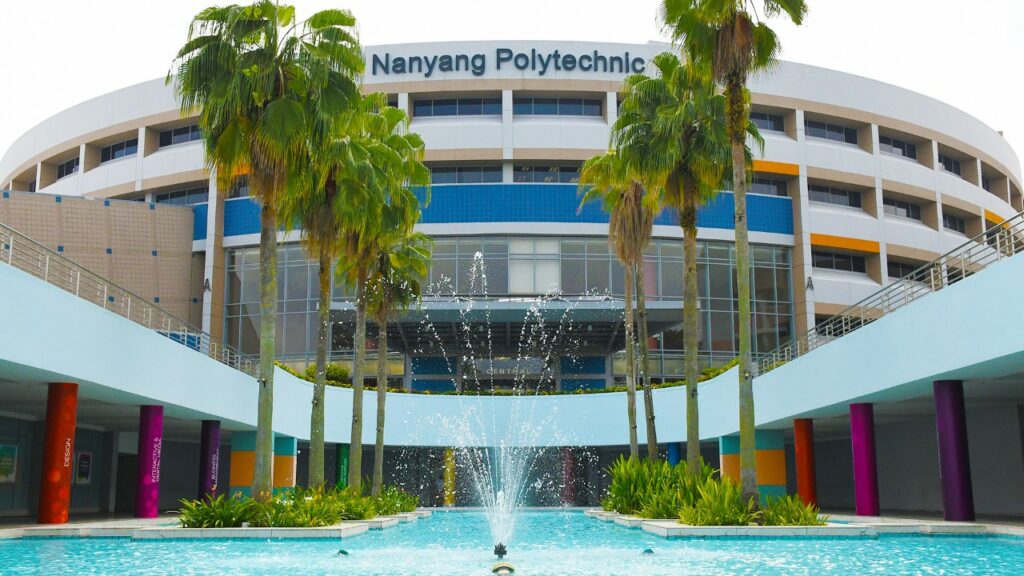

Secondary school graduates will get to enjoy proximity to popular institutions no matter which post-secondary route they decide to take. For starters, ITE College Central is the closest to Pollen Collection and can be accessed via the CTE within 8 minutes by car and 11 minutes by bike. In particular, the comfortable cycling distance means that students will get to stay healthy while also enjoying quick commutes to and from lectures.

Students going to the polytechnic route can enjoy four bus services (159, 50, 72, 88) for a quick 30-minute commute to Nanyang Polytechnic. Finally, bus 70 takes students of Anderson-Serangoon Junior College directly to and from their homes. Nestled within close proximity to all three institutions is Yio Chu Kang Stadium to provide students with a convenient option for running, swimming and going to the gym between classes.

Jobs are aplenty at Ang Mo Kio Industrial Park

Engineers and corporate workers may not get to work from home as often, but living at Pollen Collection means quick access to jobs in the industries of semiconductors, health information systems, tech, data, telecommunications and more thanks to Ang Mo Kio Industrial Park in your backyard.

Whether you’re commuting to work via bicycle, car, or even on foot, you’ll reach the likes of STMicroelectronics, Singtel Mobile Office, IHiS and Daikin Airconditioning within 10-15 minutes. For industries where hours are long and work is physically taxing, living this close to home will always be welcome, where a refreshing shower and even home-cooked lunches are never too far away.

Looking for private property?

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home buying decision, so you no longer have to spend hours searching online for the information that you need. Because at Ohmyhome, we’re always by your side, always on your side.

You can message us in the chatbox at the bottom, right-hand corner of the screen to secure an appointment with any of our Super Agents.. You can also WhatsApp us at 9755 9283!

Read about other future private developments in Singapore

- Former Surrey Point in Newton Acquired for New Residential Development

- Upcoming New Launch at Slim Barracks Rise Parcel A & Parcel B

- New Launch at Jalan Anak Bukit: The Complete Package for Green Urban Living

- New Project Alert: What to Expect From Mixed-Use Development on Marina View GLS Site?

- A Guide: Paya Lebar Airbase Redevelopment Plans (Part 1) | (Part 2)

- Price Trend Analysis: A Look Into the Next Condo Launch at Jalan Tembusu

- Upcoming Condo to Watch: Pine Grove (Parcel A) 2022

Home Renovation Ideas: Top 5 Interior Design Trends You’ll See Everywhere in 2022

An older version of this article from March 2021 is available here.

Though restrictions have been easing up and we’re witnessing the dawn of a new era where COVID is treated almost as dismissively as the common flu, we foresee some COVID-inspired interior design trends that are here to stay.

1. A Zoom room

The Zoom Room is just pandemic speak for a really swell, pimped-out home office you can show off on video calls without having to resort to a virtual background to hide the unsightly state of your now very lived-in home. A Zoom Room isn’t necessarily an actual room. For those of us with shallow pockets and deep creativity, a Zoom Room could easily be a designated corner or room in your home with a “curated background” that just so happens to fit into your video call frame so you always look work-ready in your meetings.

These spaces are decluttered and set away from communal parts of the house, so you never have embarrassing moments of a child screaming in the background or an elderly grandpa wandering across the screen in his boxers. Although most offices are now back in full force, we foresee homeowners keeping a “Zoom Room” ready in their homes in case of an unexpected lockdown. It also makes an alternative high-productivity area for the times when you need to work from home on weekends or after hours.

2. Neutral palettes

There is only so much character we can take from a room we live and breathe in day after day. With the two lockdowns we have experienced, many homeowners and interior design professionals now truly understand the meaning of getting “stir-crazy” and the need for an environment with a clean, simple palette.

More homeowners are now opting for cleaner colour palettes in home designs, with “comfort” and “timelessness” being key considerations in their colour picks for their living spaces. Whites, creams, beiges, pale to darker grays, and other neutral tones remain popular options.

On the same note, the minimalist trend saw homeowners on a decluttering spree to make living spaces more livable; we foresee this trend will carry on post-COVID as we get used to seeing clean, open spaces within our homes.

Read more about home renovation and interior design:

- 5 Home Renovation Concerns All Homeowners Worry About

- 2022 Feng Shui Tips to Invite Good Fortune Into Your Home

- How to Choose the Right Sanitary Fittings When Remodelling Your Bathroom

- How to Renovate Your Resale HDB Flat: Timeline and Procedure

3. Not mixing work and play

Move over, open-concept homes. COVID saw homeowners and designers swapping out open-plan spaces for purposefully-designed ‘cocoons’ that offer privacy and focus, and with larger communal spaces that serve as ‘break areas’, to cater to clearly defined work and play environments. Having clear “sections” and rooms also became crucial for those sharing a house with a family member with COVID or under quarantine.

Rooms that were dedicated to playtime, also helped keep the kids away. Many homeowners child-proofed their homes or designed playrooms to keep the children within confined play zones, allowing a space where the little ones can go crazy, even draw on blackboard or whiteboard laminated walls, to unleash their creativity and hopefully expand all that boundless energy.

4. Let there be light

As more and more of us got increasingly used to working from home, the need for brighter, lighter spaces became a necessity.

As new technologies pop up, promising to mimic daylight, complement mixed design themes, or enhance various moods, increase productivity or promote better sleep, homeowners have begun to see lighting as key to home design. Gone are the days when a single light switch controlled one austere light bulb that was supposed to provide all the light in a single room. These days, a mix of overhead lighting, standing lamps, and mood lighting are combined to create highly livable and convertible spaces to cater to changing needs.

5. Material matters

Interior design trends are witnessing a massive rise in the demand for furniture and surfaces made of sustainable, low-maintenance materials. Choosing low-maintenance materials like quartz countertops (no staining, scratch-resistant) in place of high-maintenance, porous materials like marble, or picking composite materials (no bloating, no rotting) instead of actual wood, means less cleaning. Throw in the fact you may be sharing a home with sticky-fingered children or an adult who hasn’t gotten the hang of “adulting” and you will find a low-maintenance home can go a long way in preserving your sanity.

Need a home makeover? Ohmyhome Renovations is here to turn your vision into reality!

Renovation not just improves the overall value and aesthetic of your house, but it allows you to enjoy your home to the fullest and incorporate a part of yourself into the spaces around you. So sit back, relax and let us turn your house into a home, because at Ohmyhome, we’re always by your side, on your side.

Engage our experienced team of interior designers and contractors for a well-executed home renovation project. Call us at 6886 9009 to secure an appointment with any of our Interior Designers or message us in the chatbox at the bottom, right-hand corner of the screen. You can also WhatsApp us at 9755 9283! Or get a free quote for your home in seconds!

Read about these Instagram influencers’ homes and interior design inspirations:

Former Surrey Point in Newton Acquired for New Residential Development

A new, freehold residential development is coming to the Newton area! The former Surrey Point, at the junction of Surrey Road and Newton Road, has been acquired by Singapore-based property developer and hotelier Amara Holdings for $47.8 million or $1,434 per square foot per plot ratio (psf ppr).

The 11,977 sq ft 10-storey apartment building was launched for collective sale via public tender in January 2021, with a maximum permissible gross floor area (GFA) of 35,882 sq ft, inclusive of the additional 7% bonus GFA for balconies. Property experts predict that the site, which is well-located and attractively priced for discerning homebuyers, can yield 36 units with an average size of 914 sq ft.

While Surrey Point’s residential successor will likely be in the pricier range, property experts have noted the palatable development charge of $294,000. On top of that, factors such as its proximity to the Newton MRT Interchange, about a 10-minute walk away, prestigious schools and major shopping districts may have boosted investor confidence in the land’s sale potential as well.

What sets the new launch at former Surrey Point apart?

Unparalleled accessibility

Leisurely pacing down Newton Road to cross Dunearn Road and the Newton Flyover will take you to Newton MRT Interchange in less than 10 minutes. This literally puts you within one stop of the food and shopping districts of Orchard Road and Little India via the North-South Line and Downtown Line respectively.

If you’d rather not take the train to get your retail therapy fix, then there are still plenty of options within walking distance. Novena Square shopping mall can be reached within a short 5-minute drive, and the United Square Shopping Mall is even closer in just 3 minutes. In fact, you could get there in just 6 minutes on foot if someone else is using the family car.

And if you thought that that was all Surrey Point has to offer, you thought wrong! Fancier retail options are aplenty at Courtyard by Marriott Hotel and Royal Square, both taking just slightly over 10 minutes by car. For a little bit of nostalgia, you can also hop over to Goldhill Shopping Centre in just 5-minutes.

No shortage of local cuisine

In the unlikely scenario where you grow bored of the food found within the various shopping malls, nostalgic local gems are just waiting around the corner for you to try. The lesser known Pek Kio Market & Food Centre, while inaccessible to most, can be reached from your residential area in a short 5-minute drive. Not only is this underrated food court home to the Michelin Hong Kong Style Pin Wei Chee Cheong Fun, you’ll also find classics such as carrot cake and fried prawn noodles here.

And if you want a classic chinese banquet-style feast to celebrate the occasions, Chui Huay Lim Teochew Cuisine can be found right next to Rochelle@Newton and Newton Life Church just 6-minutes away by foot. Serving heritage on a plate from Singapore’s founding Chinese dialect group, diners will get to enjoy elevated classics such as braised duck with beancurd slices and luxuriously smooth yam paste.

An impressive line of educational institutions

Living at the former Surrey Point means receiving priority registration into some of Singapore’s top primary schools. Anglo-Chinese School (Primary), Anglo-Chinese School (Junior) and St. Joseph’s Institution Junior all lie within the 2km radius of the residential site. This gives your children an excellent chance at getting priority slots during primary one registration.

Both Anglo-Chinese schools can be reached within just 4 minutes by car. Students attending the Primary institution will also get a wide selection of direct buses to choose from, namely 48, 67, 960 and 972M. Home will be nearby for students who attend the other institutions, too, considering that Anglo-Chinese School (Junior) and St. Joseph’s Institution Junior are just a 12-minute and 9-minute walk away respectively.

Moving onto the secondary level, students will get to choose between two distinguished options in Singapore Chinese Girls’ School and ACS (Barker Road). Located just outside the residential’s 2km radius, Singapore Chinese Girls’ School can also be reached via the same bus services that link students up with Anglo-Chinese School (Primary), allowing for a smoother transition into secondary school level as graduates can continue taking familiar bus routes.

Singapore Chinese Girls’ school offers both the 4-year GCE ‘O’ Level track as well as a 6-year Integrated program which will allow qualifying students to attain direct entry into Eunoia Junior College. While Eunoia Junior College is a little further away at Marymount, students will be able to take a restful 45-minute journey to and from school via the direct bus of 162.

Just 1.7km and a 4-minute drive away is ACS (Barker Road), a school that offers the three traditional routes of Express, Normal (Academic) and Normal (Technical) streams. ACS (Barker Road) is one of the 30+ schools to offer Full Subject-Based Banding from 2022 as well as customised 1-to-1 digital device learning to encourage self-directed study and a personalised approach to academics. Students can also enjoy the same four bus services for a short 13-minute ride to and from school.

Healthcare assurance with Tan Tock Seng and KK Hospital

Residents with chronic health conditions, elderly members, or parents who wish to give birth to more children will be in very good hands because the future residential at Surrey Point will not only be served by one, but two hospitals.

Tan Tock Seng Hospital is just a 5-minute drive away and can even be reached in 5-minutes by bike. The bike option is admittedly not ideal for patients who are not in the pink of health, but can be a quick way for caretakers and family members to pick up medical supplies. Patients who naturally do not fancy the idea of riding a bike to receive medical attention can head down to KK Women’s and Children’s Hospital in 12-minutes via a bevy of bus services (56, 57, 166, 851, 980). For emergencies, the hospital can be reached within 4-minutes by driving along Thomson Road and Newton Road.

Looking for private property?

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home buying decision, so you no longer have to spend hours searching online for the information that you need. Because at Ohmyhome, we’re always by your side, always on your side.

You can message us in the chatbox at the bottom, right-hand corner of the screen to secure an appointment with any of our Super Agents.. You can also WhatsApp us at 9755 9283!

Read about other future private developments in Singapore

- Upcoming New Launch at Slim Barracks Rise Parcel A & Parcel B

- New Launch at Jalan Anak Bukit: The Complete Package for Green Urban Living

- New Project Alert: What to Expect From Mixed-Use Development on Marina View GLS Site?

- A Guide: Paya Lebar Airbase Redevelopment Plans (Part 1) | (Part 2)

- Price Trend Analysis: A Look Into the Next Condo Launch at Jalan Tembusu

- Upcoming Condo to Watch: Pine Grove (Parcel A) 2022