Article 2 – Test article for ES

Category: Uncategorized

Sample

This is a sample content _ OMH Web Team Update,.

How To Calculate Your Cash Proceeds From Your Home Sale

Congratulations! Your home has hit the 5-year Minimum Occupancy Period (MOP) and now you’re able to sell your home to reap the profits from your purchase.

It’s an exciting time, and you’re already picturing the lump sum of cash that will enter your bank account once the whole process is over.

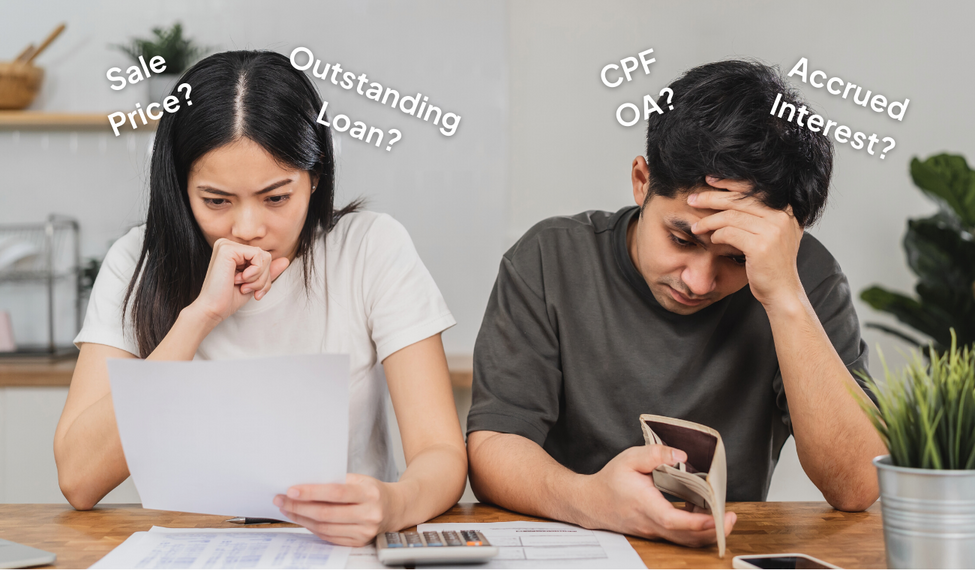

But now you’re wondering to yourself…

“How much do I actually get IN CASH after the sale?”

That’s a great question, and we’re here to answer it.

Join me and let’s do the math (one step at a time) to figure out your home sale.

The main factors we need to look at are the following:

- Sale price of your home

- Outstanding loan

- Refund of CPF OA used + Accrued interest

- Property agent fee

- Legal fee

- HDB resale fee

And profit!

So, here’s how to calculate!

Let’s say, you purchased a 4-room BTO at $400,000, 5 years ago.

With this in mind, you placed a 10% downpayment of $40,000 using your CPF and took a HDB loan of $360,000 at 2.6% per annum (p.a.) for 25 years.

As a result, that means your monthly mortgage repayment amounts to $1633.21 per month, and you decided to service the entire monthly mortgage using your CPF OA as well.

Still following along? Great. Let’s continue. (Now with formulas!)

After 5 years, your property has appreciated by 25% and grown to $500,000. A $100,000 profit — great success!

While technically correct, let’s see exactly how much you can take home in cash.

After 5 years of paying your loan, your $360,000 loan is now at $305,393.93.

As shown above, you may be wondering why after paying close to $98k, your loan principal only reduced by $54.6k. Well, that’s because only a portion of the monthly payment reduced the principal. The rest was paid to interest.

The next step is to calculate your CPF OA refund. Take note that this will be paid back to your CPF OA, not given in cash.

After using $40,000 for your downpayment and servicing your entire monthly mortgage with your CPF OA, you now owe yourself $149,585.07.

To calculate this, we use a financial calculator to find the future value of your CPF with Accrued Interest owing. You can download an app to try this for yourself or use Microsoft Excel to input the Future Value (FV) formula to find the same results.

Great. Next, you were smart to engage Ohmyhome’s Super Agent to sell your home. To reward them for their hard work at finding you a buyer who agreed to your ideal sale price, you pay a low market rate of 1% service fee + 7% GST. This amounts to $5,350.

Let’s combine the last 2 assumptions: Assuming you engage HDB’s legal services, using their helpful Legal Fees Enquiry Facility, it’ll cost you $290, with an additional resale fee of $80.

Let’s punch in the equation, shall we? (we’re almost there).

Sale price – Outstanding loan – Refund of CPF OA used with acc. interest – Property agent fee – HDB legal fee – HDB resale fee = Cash in bank

$500,000 – $305,393.93 – $149,585.07 – $5,350 – $290 – $80 = $39,301.01

To sum up, a $100,000 profit translates to…

$39,300 cash in your bank account.

“But what if I want MORE?!”

We want to help you with that.

There are 3 ways to help you earn and keep more profits in cash:

- 1) Sell your home for a higher price

- 2) Reduce your mortgage interest rate (refinancing)

- 3) Don’t use all your CPF

1) Sell your home for a higher price

This may be the most obvious solution, but it’s perhaps the hardest to achieve. The best ways to achieve a higher selling price boils down to a few factors:

Better staging of your property

There are just some things you cannot physically change. Your home’s location and its size. However, staging could help you overcome pesky “flaws” in your property.

Staging your property is the art of beautifying your home for pictures. The first thing most people see when looking at a property listing are the pictures.

Before price.

Before nearby schools.

Even before the closest amenities.

The look of the home is the reason why an interested buyer may continue to care and consider buying your home.

You don’t need to be a world-class photographer or an award-winning designer.

Just an eye for highlighting natural light and space could already win you 90% of the battle for attention.

Ohmyhome’s Super Agents are trained to do exactly that. With an average transaction of 120 HDB homes in a year, they’ve seen it all. Even smaller homes with an intimate setting can be staged to look spacious and welcoming.

Aggressive marketing

In simple economics, demand drives prices. The more people want it, the more valuable it becomes.

This is the same for your home.

Attracting more individual buyers, having the opportunity to get them to outbid one another, and closing at a higher price just to swat away other parties would certainly help you increase the sale price of your home.

However, for many of the property listing sites, you need to be a property agent yourself before you can list your home.

Another option you may have is to run advertisements and get interested buyers to contact you directly. But it comes with heavy costs that eat into your potential profits, without even considering the time you’ll have to set aside to entertain every inquiry and arrange viewings whether they’re genuine or just window shopping.

The alternative? Ohmyhome.

Ohmyhome, until today, remains the only property tech solution that allows homeowners to list their homes for free. And you can download our app here.

Our MATCH solution then pairs buyers — who have input the type of properties they’re looking for — with you, if there’s a match.

You’ll get notifications as quickly as an 18-year-old heartthrob who just joined Tinder (ah, the good ol’ days).

Real buyers with genuine interest, notified immediately.

Other agents may claim they have ready buyers for your home, but we actually have proof.

Persuasive negotiation

Finally, bringing out the inner Jordan Belfort. Remember that guy in Wolf of Wall Street?

You want to sell high, and they want to buy low.

If you want to sell your home at a higher price, you’ll have to convince your buyer that it’s worth the price.

Remember, if you’re selling your home above valuation, your buyer will have to pay a Cash Over Valuation (COV) in cash.

That’s a big commitment for them and requires expert negotiation for you to pull off.

Ordinarily, we don’t expect many homeowners to be able to do so, and that’s why it’s proven that having a seasoned property agent with years of experience could add an extra 5-15% on average in the sale price.

Here are just some examples.

Ohmyhome does it day-in-day-out, and we regularly update our latest transactions to show you how successful we are at selling homes above average transacted prices.

2) Reduce your mortgage interest rate

Your next biggest culprit in reducing your cash profits is the interest rate you’re paying.

If you were to get a mortgage rate of 1.8% p.a instead of 2.6% p.a with a bank loan, you’ll be:

- Saving $142.14/mth or $8528.61 over 5 years,

- Reducing your loan balance by $5,057.83 as more is paid to principal than interest,

- Using less CPF OA and accrued interest by $9,074.52,

- And increasing your overall cash proceeds by $14,132.35.

Altogether, that’s an extra 36% of cash profits from one little trick.

Now, we understand that as of writing, interest rates have flown through the roof. But when interest rates fall in the future, be sure to refinance your mortgage to get a better deal and to earn a higher profit overall.

Ohmyhome provides mortgage services as well, so do keep us in mind.

And last and most controversially,

3) Don’t use all your CPF

I feel like I’m going to be burned at the stake here, but the numbers don’t lie.

While your CPF OA is returned to you and you can immediately use it again for your next purchase, the double whammy of not earning interest from the government and instead paying yourself that interest is a painful pill to swallow.

From our calculations above, if you would have used cash for both the downpayment and the monthly mortgage, you would have paid $138k instead of $149k.

That’s an extra $11k that you would earn directly through your CPF interest rate from the government.

And all that $138k is returned to you in cash to use however you please.

Now, we’re not advocating for you to just use cash. In fact, that’s close to impossible for most Singaporeans.

We’re just here to present the facts and it’s up to you to decide. Perhaps a combination of both?

Let’s put it all together

If you followed our tips and…

- Sold your home for 5% more earning you an extra $25,000.

- Reduced your interest rate from 2.6% to 1.8% earning you an extra $14,000.

- And used cash instead of CPF earning you an extra $11,000.

You’ll be walking home with $50,000 in additional profits — more than doubling what we started with.

How does an extra $89k sound to you?

It’s a brand-new car, or buying your next house a few floors higher, or even paying the university tuition of your future child.

Well it sure sounds good to me.

Let us help you achieve this when you sell your home.

All you have to do is to drop us a call, message us on Whatsapp, or fill in a callback form and we’ll get back to you in 15 minutes.

Set up a meeting with our property agents and get your home-selling journey to the best start.

To more profits and a smoother experience!

Top Opportunities for Real Estate Agents in the Philippines

Imagine being a member of a network where individuals get to sell thousands of property listings nationwide all the while enjoying top-rate rewards, perks, and incentives. Members get to live the lifestyle they’ve always hoped for with the ELITE Network.

Ohmyhome expands its offerings to include the all-new ELITE Network this February 2022. The network aims to gather exemplary real estate professionals and provide them with the widest property inventory in the Philippines at their disposal. It should also allow homebuyers to transact in a faster, safer, and more efficient manner.

“What is exciting is that the platform offers a wide range of properties from Luzon to Mindanao,” says Ohmyhome Product Manager Thor Carillanes. “Another game-changing part of this inclusion is that sellers can primarily focus on selling and our team will be there to assist every step of the way.”

The network is open to all licensed brokers, accredited salespersons, or referral partners who aspire to have empowered selling expertise and lifestyle. Members get exclusive access to Ohmyhome’s extensive roster of products, partners, deals, and services. The ELITE portal should also help its members find the right match for their buyers’ preferences and requirements.

“Ohmyhome’s ELITE Network enables its members to elevate their property selling expertise through our new portal. Here, they can browse listings, manage sales transactions, and monitor their incentive payouts with ease,” says Ohmyhome’s Strategic Partnerships Manager and ELITE Network Project Lead Cielo Dumlao.

Each member will be given access to the ELITE online portal and its dashboard, where they can view project information, sales numbers, presentations, and the like. A dedicated Ohmyhome team will also be managing clients so members can focus on selling.

“The ultimate goal is for members to make the sales transactions process more convenient for them. Through the ELITE Network, everything they need to close a sale can be found on the portal, from property listings and inventories, presentation materials, and documentation requirements. Members can even hold and reserve a property through the platform.” adds Dumlao.

Top-performing earners are set to receive lucrative rewards and incentives from their sales. This includes cash, cars, mobile devices, and more. Members are also encouraged to expand their own network of ELITE members so they can maximize their earning potential with referral incentives.

“Each ELITE member will be treated like a VIP. They will be given comprehensive assistance on their sales transaction process, conduct exclusive training and seminars to develop their selling expertise, and incentives for every sale and member referral,” explains Dumlao.

The ELITE network is a pioneer, revolutionizing the local real estate industry with its dynamic new platform.

The ELITE Network aims to provide earning opportunities through Ohmyhome’s roster of services, deals, and products. It allows members to better transact with their buyers in a faster, safer, and more efficient manner. The portal should also serve as members’ gateway to finding the perfect property match for each client.

Ohmyhome was launched in the Philippines in September 2020, following the company’s establishment of a tech team in the country in 2017. Ohmyhome was originally founded in 2016, and subsequently rose in Singapore as a leading PropTech solution and licensed real estate agency.

Ohmyhome expanded into the Philippines so that Filipino home seekers can have a real estate partner that they can trust to have their best interests at heart and can be relied upon to provide exceptional services throughout the entire property journey.

Featuring thousands of properties across many of the Philippines’ major real estate brands, Ohmyhome differs from other local platforms by going the extra mile and extensively helping buyers narrow down their choices and find the property that best suits their budgets, home needs, and lifestyle preferences.

The company prides itself on top-caliber real estate professionals who have a wide range of expertise in the industry. These professionals are committed to providing turnkey solutions, including property inspections, negotiations, the finalization of the Conditions of Sale, deposit collection, the submission of property documents, as well as providing buyers regular updates.

Ohmyhome helps every Filipino find their much-awaited dream home, all while making sure that each real estate transaction is complete and efficient, and most of all, an enjoyable experience!Stay connected with Ohmyhome Philippines by following our official Facebook, Instagram, and LinkedIn accounts.

5 Simple Ways To Spot Undervalued Properties in Singapore 2022

The real estate market in Singapore is becoming more and more of a mystery to buyers and investors alike. Despite the ongoing pandemic, property prices reached record highs last year which led to the raised ABSD rates and other cooling measures introduced in December last year.

So spotting an “undervalued” home may seem challenging for buyers. An undervalued property is usually priced lower than its market value or bank valuation.

5 tips to spot “undervalued” properties

1. Study the price gap between a new and resale property in the same area

How different are the prices between a new launch and a resale home in the district you are looking at? If the gap is at least 20%, the resale property is worth looking at.

Apart from being either public or private housing, and freehold or leasehold, most homes in Singapore are priced according to their location, so a decent price gap shows that you are getting a similar property at a better value.

2. Look for older listings

Check for listings that have been up for a while. These tend to have higher chances of being undervalued as most sellers have a given time frame to sell their property.

As the deadline draws near, they might be more open to negotiation.

3. Figure out the seller’s motivation

There are often multiple reasons why a person wants to sell his or her home. They may have already purchased a new property, or they may be in financial trouble.

These sellers will likely accept lower offers and sell their properties below the bank valuation as they need to let their current one-off quickly for cash.

4. How many listings are there?

It is harder for sellers to get rid of their current place in areas with more listings due to competition. Sellers may be more willing to let their homes go at lower prices to entice buyers.

5. When is the Additional Buyer’s Stamp Duty (ABSD) deadline?

There are two ABSD deadlines to take note of.

Developers’ ABSD: Developers have to pay a 40% stamp duty on the land they build their project on. They can get 35% of that stamp duty back if they meet the conditions set by the Inland Revenue Authority of Singapore.

Some developers may sell their units at a cheaper rate close to the five-year mark as they want to avoid the extra cost. The same goes with home sellers.

Sellers’ ABSD: If you currently own an HDB flat and are looking to purchase a private property as a new home, or if you’re buying another private property, you’ll need to pay for the ABSD upfront (in cash or CPF) within 14 days of signing the Sale and Purchase Agreement.

You can apply for an ABSD remission upon selling your existing home within six months.

The ABSD rate has been raised from 12% to 17% in December last year.

View this post on Instagram

But if you’re buying a new Executive Condominium (EC), you won’t have to pay ABSD upfront. You will, however, need to sell your home within six months after collecting your keys or after it has received its Temporary Occupation Permit.

These sellers may offer a discount on the property if their ABSD deadline is coming soon.

Stay Sharp

Remember to calculate the number of years the property has left on its lease. It may seem sufficient currently, but it may become much harder to sell in the future, especially after your property turns 30 if it has a 99-year lease.

Even if you are not looking for a home right now, keep studying the property market. Higher or lower transaction volumes are usually a sign of whether the market is getting hotter or headed for a downturn. This will tell you if you should strike while the iron is hot, or to hold back for the time being.

This article was originally published on Planner Bee.