Every quarter, The Housing & Development Board (HDB) releases a comprehensive database of price indices and sales volume for the public housing segment. Ohmyhome analyses this huge chunk of data and picks out the most relevant points and trends for readers.

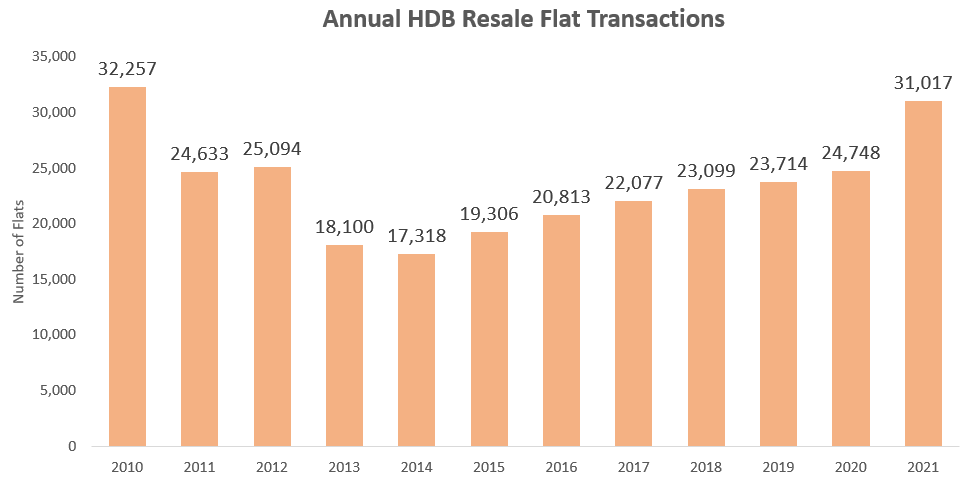

Highest recorded HDB resale transactions since 2010

HDB resale transactions in 2021 rose by 25.3%, with 31,017 resale flats transacted as compared to the 24,748 flats sold in 2020. This was the highest recorded number of HDB resale transactions since 2010, when there were 32,257 resale transactions. On average, there were about 2,400 HDB resale transactions occurring in most of the months in 2021.

The impressive HDB resale market performance was not entirely unexpected. When the year 2021 kicked off, there were over 25,000 HDB flats that were expected to reach their 5-year Minimum Occupation Period (MOP), making them eligible to be resold.

This supply of resale units played a pivotal role in stimulating demand as HDB resale prices were already on its road to recovery when the year began. When prices recovered, HDB flat owners saw an opportunity to sell their flats.

Throughout the year, there were a myriad of factors that led to an upswing in HDB resale transactions.

Vaccine optimism, a positive economic outlook, renewed market confidence and a low interest rate environment fuelled demand for the HDB resale market in 2021. One major proponent of this increase was the uncertainties in the construction industry.

The delays in the construction of BTO flats prompted buyers to shift their interest towards the HDB resale market. Couples with a pressing need for immediate homes, were enticed to consider the resale market as opposed to rolling the dice with the BTO flats.

Top Performing Towns in 2021: Punggol & Sengkang

Based on the information gathered from data.gov.sg, the top selling towns in 2021 were primarily in Sengkang, Punggol, Tampines, Yishun and Woodlands. This was rightfully so, with about 9,000 flats in these estates reaching their MOP in 2021, which contributed to the rise in transactions. There were also no new BTO launches in Sengkang and Punggol in 2021.

Newer HDB flats with a remaining lease balance of 89 years and above accounted for the highest percentage in terms of remaining lease balance. It was about 29.9% of the overall HDB resale transactions in 2021. These flats were primarily from non-mature estates such as Punggol, Sengkang, Choa Chu Kang and Yishun. Buyers who are looking to move in without doing major renovations would be attracted to towns with younger HDB flats.

5-room flats see higher median price growth in 2021

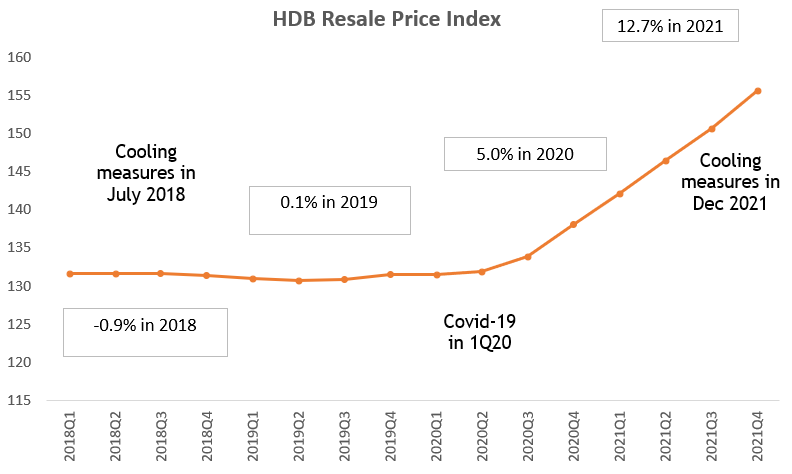

Overall HDB resale prices increased to 12.7% in 2021 as compared to the 5.0% price growth in 2020. This was the highest percentage change in prices since 2010, when it registered a 14.1% price change.

The median HDB resale prices of the varying HDB flat types saw a rise across the board in 2021, boosting the overall increase in prices.

The HDB 5-room flats had the highest price expansion among the different flat types in 4Q 2021 as the median price of such flats rose by 12.3% as compared to 1Q 2021.

This is due to more demand being generated for 5-room flats. The interest for a bigger space stemming from the work-from-home culture has invigorated the demand for such flats.

According to Singapore Department of Statistics’ Population Trends in 2021, more than half of the resident population were living in residences that were above 100 square metres.

Clementi had the highest median price change for a 4-room flat in 2021, as prices grew from $560k in 1Q21 to $728k in 4Q21. This accounted for a 30.0% increase. This is primarily due to the million dollar deals occurring in the estate.

Record-setting number of million-dollar deals in 2021

There were a total of 259 million-dollar HDB resale transactions (updated figures) in 2021, exceeding previous years’ records, and is the highest ever recorded number of million dollar deals in a single year. With million dollar deals reaching new highs on a monthly basis in 2021.

Pinnacle @ Duxton amassed a total of 75 deals in a single year. And the most expensive flat sold in 2021 was at Bishan’s Natura Loft, a 5-room flat sold at a price of $1.36 million.

The determinants that will impact the HDB resale market in 2022

Despite a potential dip in resale transactions, we still expect the HDB resale demand to remain healthy in 2022. This is due to the resiliency of the HDB resale market.

1. First-timers with immediate housing needs

First-time buyers are the cornerstone of the HDB resale market as they are undeterred by the property cooling measures. So, demand for HDB resale flats will primarily be spurred by them as they are mainly aiming to fulfill their need to “put a roof over their heads” in the shortest time period possible. Hence, demand for public housing is unlikely to decline at an alarming rate in 2022.

Based on the preliminary data available, there are already about 2,100 flats transacted in January. For the majority of Singaporeans, public housing is their popular choice in terms of housing.

The streamlined sale process and the shorter waiting time generally provides an ease of convenience for aspiring buyers. The affordable nature of HDB resale flats for eligible first-timer families, makes it a viable option. Eligible first-timer families are able to access up to $160,000 in housing grants, comprising a CPF Housing Grant, an Enhanced CPF Housing Grant and a Proximity Housing Grant (PHG).

2. The BTO Opposers

In the first half of 2022, HDB is expected to offer about 9,000 Build-to-Order (BTO) flats. They are projected to be in mature estates such as Geylang, Kallang/Whampoa, Bukit Merah, Queenstown, Tampines and Toa Payoh. There is a possibility that some of it might be offered under the Prime Location Public Housing (PLH) model.

Although there is a ramp-up in supply of BTO flats, they will still require time to be built. According to the statement released by the Ministry of National Development (MND) as part of a written parliamentary reply in January – the waiting time for the February BTO exercise is expected to be in the range between 2.5 to 5.5 years

If the growing threat of the latest Omicron variant worsens globally, travel curbs and restrictions may come into play once again. This could further exacerbate uncertainties in the completion of BTO flats.

With such likelihood of ambiguities, buyers who are risk-averse and couples who are considering getting married and moving in together this year will likely shift their attention towards the resale market.

3. The watchful buyer and the conservative seller

Market participants who are on the sidelines might be anticipating a price drop amid the property cooling measures. Meanwhile, sellers who are foreseeing such probable price decline might be on the fence about selling their properties in the short-term.

Hence, some buyers and sellers may postpone their decisions in the immediate future. However, these groups of buyers and sellers will not necessarily trigger an overreaction in the HDB resale market.

As prices are typically influenced by a wide range of factors that includes location, size, the level of flat and the condition. Vigilant buyers and sellers will exercise caution and undertake the necessary due diligence needed before proceeding with the sale or purchase of their flats.

4. The million-dollar deal seekers

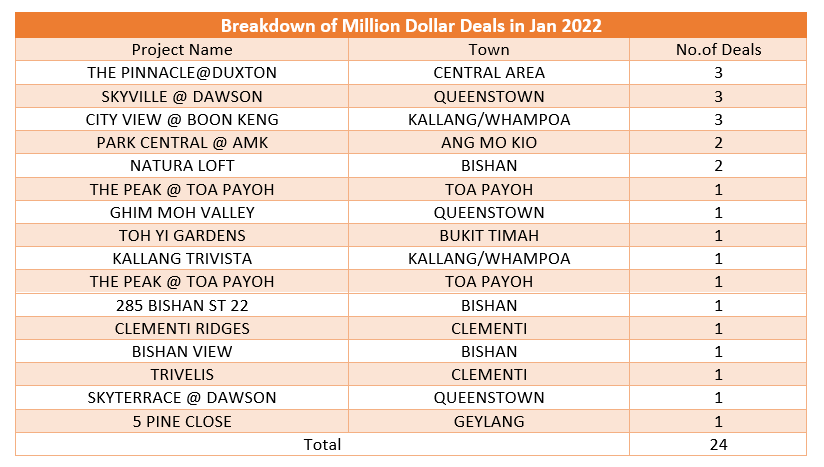

Although, we are expecting the million-dollar trend to continue at a slower pace amid the presence of the cooling measures that are in place, past hotspot areas that had million-dollar deals will persist in 2022.

Based on the information retrieved so far, there have already been 24 million dollar deals in January 2022. Buyers of such flats are generally people with deep pockets that place high emphasis on locational attributes and a spacious home. Hence, they are undeterred by the cooling measures in place.

Outlook for HDB resale market in 2022

With the aforementioned factors playing a pivotal role in stimulating demand in the HDB resale market, we expect a modest drop in HDB resale transactions in the first half of 2022 as the market readjusts to the cooling measures. We are expecting HDB resale volume to be resilient in the range of 12,000 to 13,000 in the first half of 2022. This is a mild decline of 14% as compared to the 14,644 resale transactions in the same time period in 2021.

It is likely that prices would be growing at a slower pace in the range of 2% to 3%, compared to the 6% increase in the first half of 2021.

For million-dollar deals, we are estimating that the number of deals will be between 0.6% to 0.8% of the overall HDB resale volume in 2022. While there may not be an instant plunge in prices, we can anticipate a semblance of modest price movement in the first half of 2022.

Looking for an HDB or private property?

Here’s how you can speed up your home search

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home buying decision, so you no longer have to spend hours searching online for the information that you need.

You can message us in the chatbox at the bottom, right-hand corner of the screen to secure an appointment with any of our Super Agents.. You can also WhatsApp us at 9727 5270!

Header Image: Pixabay